Life rarely follows a straight line, and for many, that’s what makes it interesting. When it comes to financial wellbeing, the shape of the line doesn’t matter as much as the direction it is headed in. What’s important is feeling confident, supported, and in control of your future.

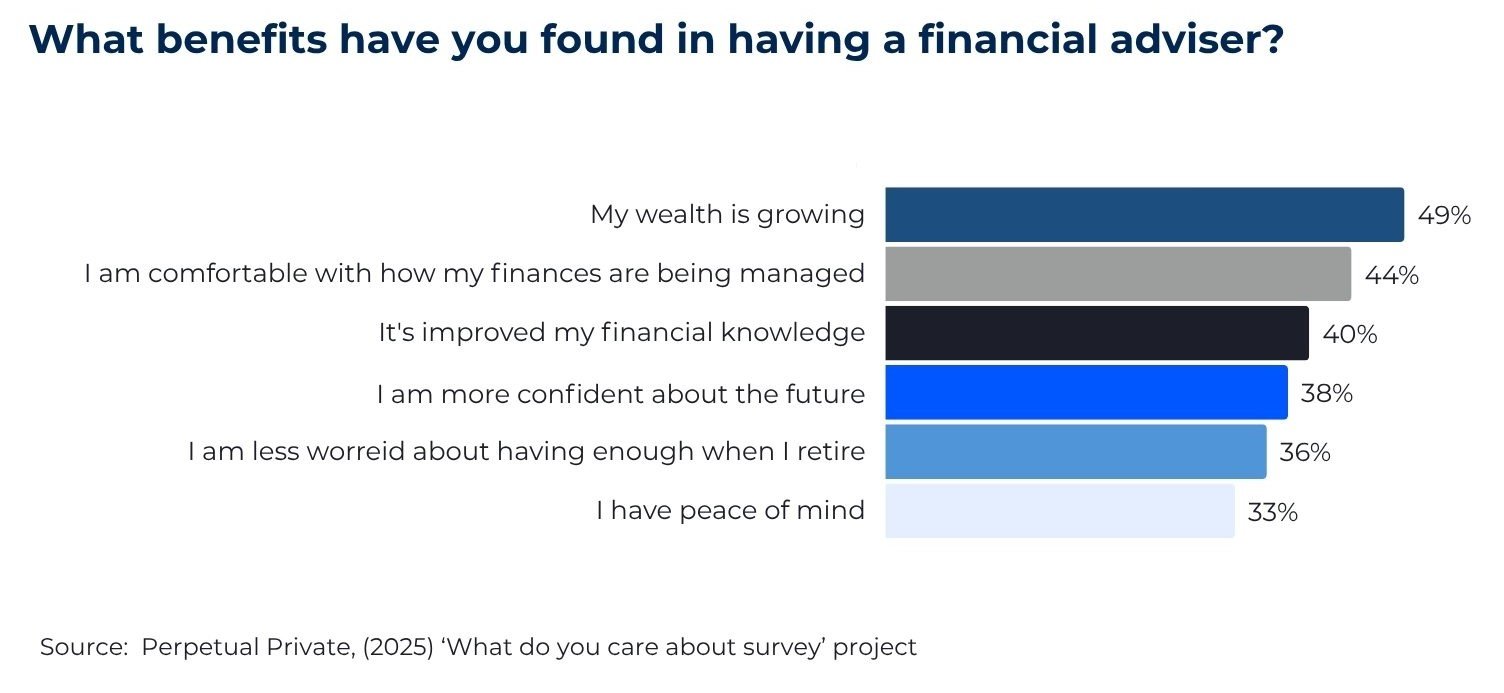

Insights based on Perpetual’s 2024 ‘What do you care about?’ survey of 3000 Australians, we looked at Australian women who partner with a financial adviser what benefits they have gained from their relationship, and there were many.

The chart below shows the top six.

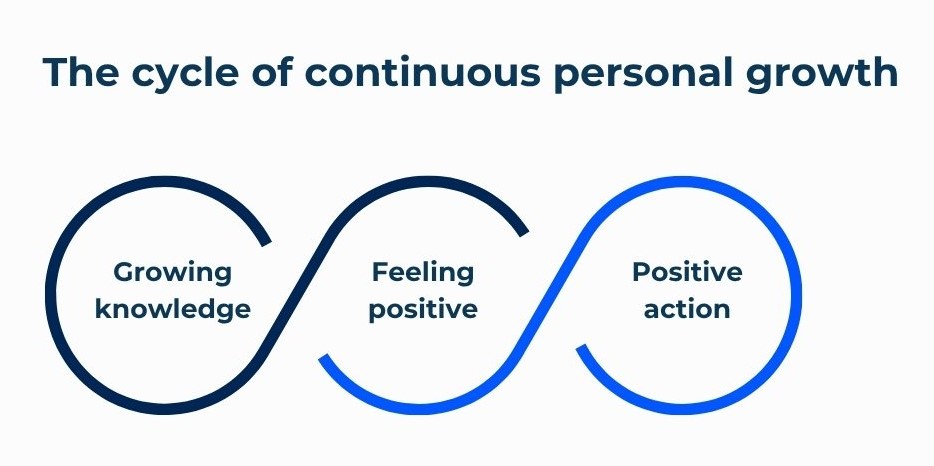

As we looked closer at these benefits we also identified that they form a kind of ‘virtuous circle’. Emotional benefits like confidence and comfort reinforce practical outcomes like financial progress and knowledge. And when these elements work in tandem, financial wellbeing is not just improved - it’s sustained.

Wellbeing is holistic

As Kathy Porter, Senior Financial Adviser at Perpetual Private, puts it:

“I absolutely believe that financial wellbeing is part of overall wellbeing and closely linked to physical wellbeing and mental wellbeing – each of these pillars are enablers for all parts of life. Wellbeing takes discipline but ultimately this discipline becomes habitual and then daily choices work to enhance us as individuals.”

This insight reflects what many women already know intuitively: that financial wellbeing does not exist in isolation. It’s deeply intertwined with how we feel, how we live, and how we care for ourselves. In our What do you care about? Survey, as women's perception of their financial wellbeing improves, so does their propensity to say they feel happy, comfortable, relaxed, optimistic and safe about life.*

Financial wellbeing and personal wellbeing have parallels that are hard to ignore. Looking more closely at the benefits of financial advice, the importance of emotional benefits, such as confidence and comfort, is clear. The tangible benefits of financial progress and expanding knowledge are similarly obvious. When these are aligned, financial wellbeing is enhanced.

Physical and emotional wellbeing follow a similar pattern. Women who care about their physical health are twice as likely to claim healthy food and exercise are most beneficial for their mental health.

Having an active advice relationship can be just as nourishing as an active focus on health and personal wellbeing. The benefits transcend the numbers, and the path is yours to choose.

More than just the numbers

A great financial adviser does more than manage money. They help you define what matters most, create a plan to get there, and support you through life’s inevitable twists and turns. The benefits transcend the numbers - they touch every part of life.

Whether you’re planning for retirement, navigating a career change, or simply seeking peace of mind, financial advice can be a powerful enabler. It’s not about perfection - it’s about progress, clarity, and confidence.

And just like with health and wellbeing, the more consistent your efforts, the more natural and empowering they become.

* Perpetual "What do you care about? Project 2024-The Mind Edition"