A great celebration starts with interesting ideas and clever planning, and the skill to execute them. Whether it’s choosing cocktails or casual, inviting friends with flair, or having a meaningful purpose, most decisions in life benefit from a thoughtful, well-planned approach. The decision to seek financial advice is no different.

We recently asked Australian women what helps them most when making better decisions[1]. Unsurprisingly, talking and listening, seeking a second or expert opinion, and giving it time were near the top of the list. But what surprised us was that experience ranked at the very top, well above everything else.

It made us wonder: how do women approach the task of finding a financial adviser when they may have little or no experience doing so?

What's holding women back?

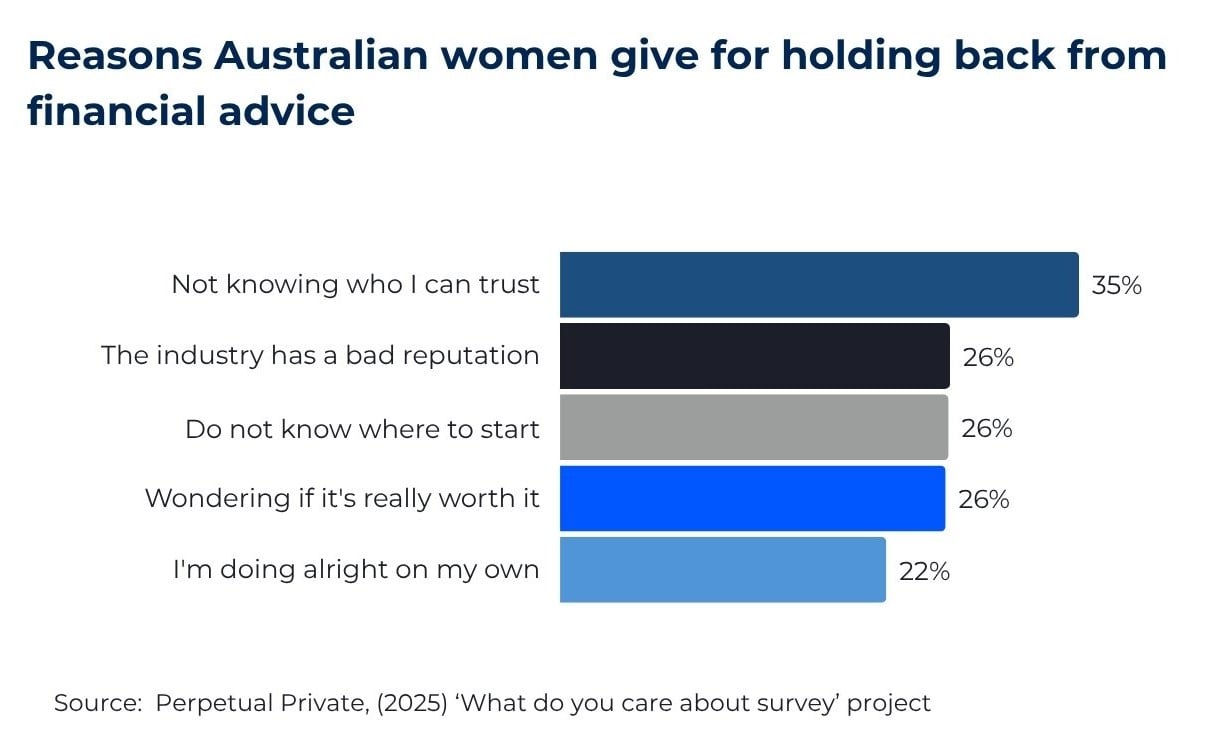

While many women express strong reasons to seek financial advice, they also share compelling reasons for hesitation. The top five reasons women considering advice have not followed the path are shown in the chart below.

Knowing the above, perhaps there is a way to apply your wealth of experience to making the decision.

Turning experience into action

Trust is not only the biggest reason women hesitate to seek financial advice—it’s also the most important factor for those who do. There are two things that women do exceptionally well that can help deal with the question of trust; the ability to have quality conversations and the willingness to seek tangible evidence when making decisions.

When asked about topics they feel comfortable talking about with family, Australian women were significantly more likely than men to be willing to talk about 11 topics from 18¹. For Australian men there was just one.

Similarly, Australian women are significantly more likely to ‘do a lot of research’¹ when making decisions that require a bit of thought and expertise

Talking to friends, family, colleagues and professionals such as your accountant can help guide the way. Asking prospective advisers to provide evidence of the quality of their relationships with clients and the track record of their organisation will go a long way to forming a view of whether they can be trusted.

As Marisa Senese, Senior Financial Adviser at Perpetual Private, explains:

“Advisers provide perspective, expertise, and sometimes the motivation to turn ideas into actionable plans. Advisers help you build momentum. Taking the first step with an adviser can create a positive domino effect - the earlier you start with guidance, the greater the cumulative benefits over time can be.”

The power of starting

Once the trust question can be answered, the path to advice will be clearer and celebrating your good judgement a reality. And just like a well-planned celebration, the results can be deeply rewarding. With the right adviser, your ideas become plans, your plans become action, and your actions build momentum.

[1] Perpetual “What do you care about? Project -The Mind Edition 2024