Whether you are out for a night of dancing, working on your PHD or running a business, your choice of partner can have a major impact on your chances of success and the fun you have in the process.

Choosing a financial adviser is no different. Working with a like-minded person who is focused on your needs and understands where you are headed, can lead to a lasting and fruitful relationship.

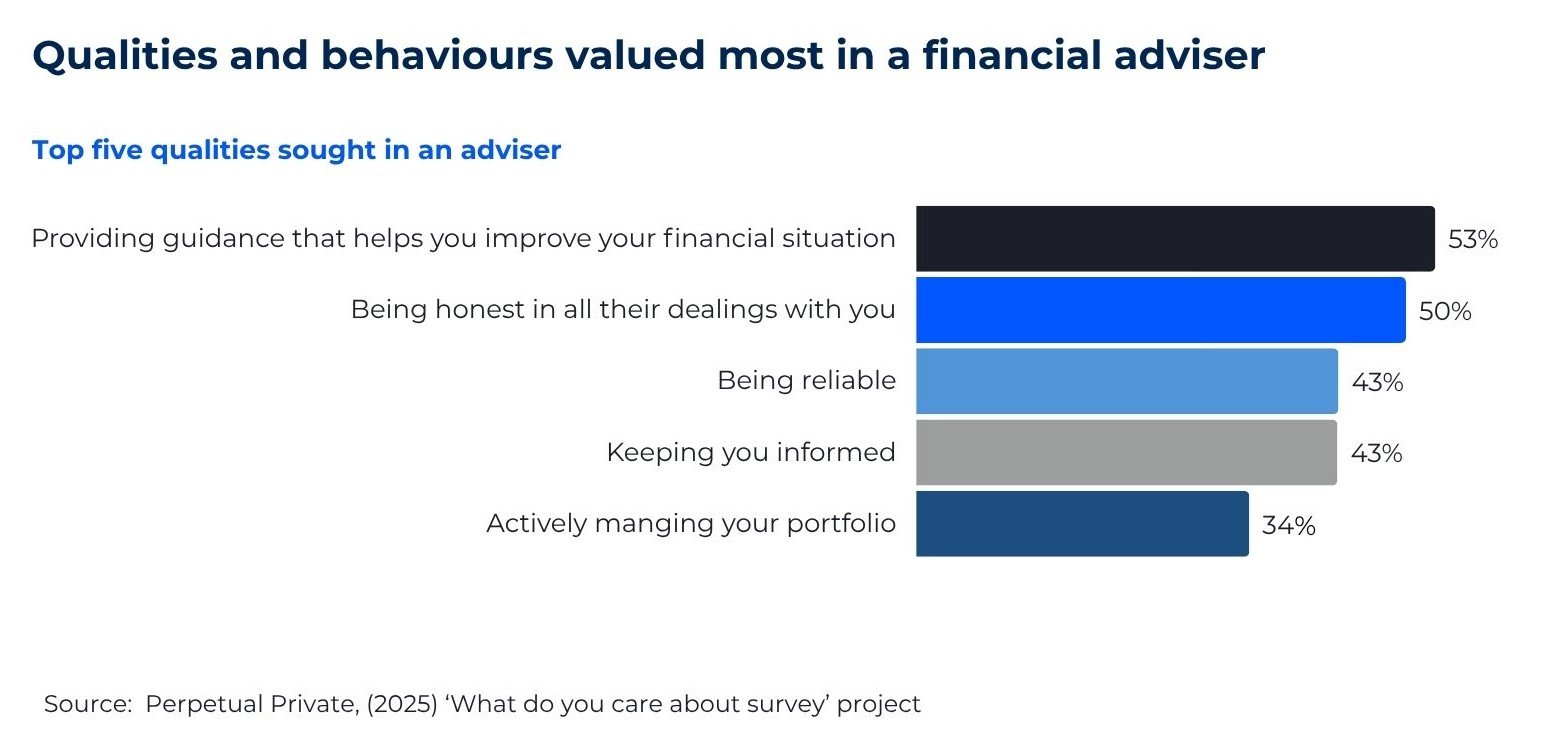

We asked Australian women about the qualities and behaviours they value most in a financial adviser. The chart below shows the top five things women are looking for.

At first glance, these seem like qualities every adviser should have – but that’s not always the case. Look closer and a common thread appears: these behaviours reflect a genuine commitment to you – the kind of care that turns advice into a true partnership.

In our What do you care about? survey, many women described ‘caring’ as one of their strongest personal qualities – often expressed as care for people, the planet and the future. They also told us that values such as thoughtfulness, commitment, sensitivity and compassion are especially important when choosing an adviser*.

That’s why ‘caring’ isn’t a soft add on; it shows up in practical ways – an adviser who listens before recommending, explains options in plain language, checks in through change, and proactively manages your strategy with your goals front of mind.

What might be running through your mind?

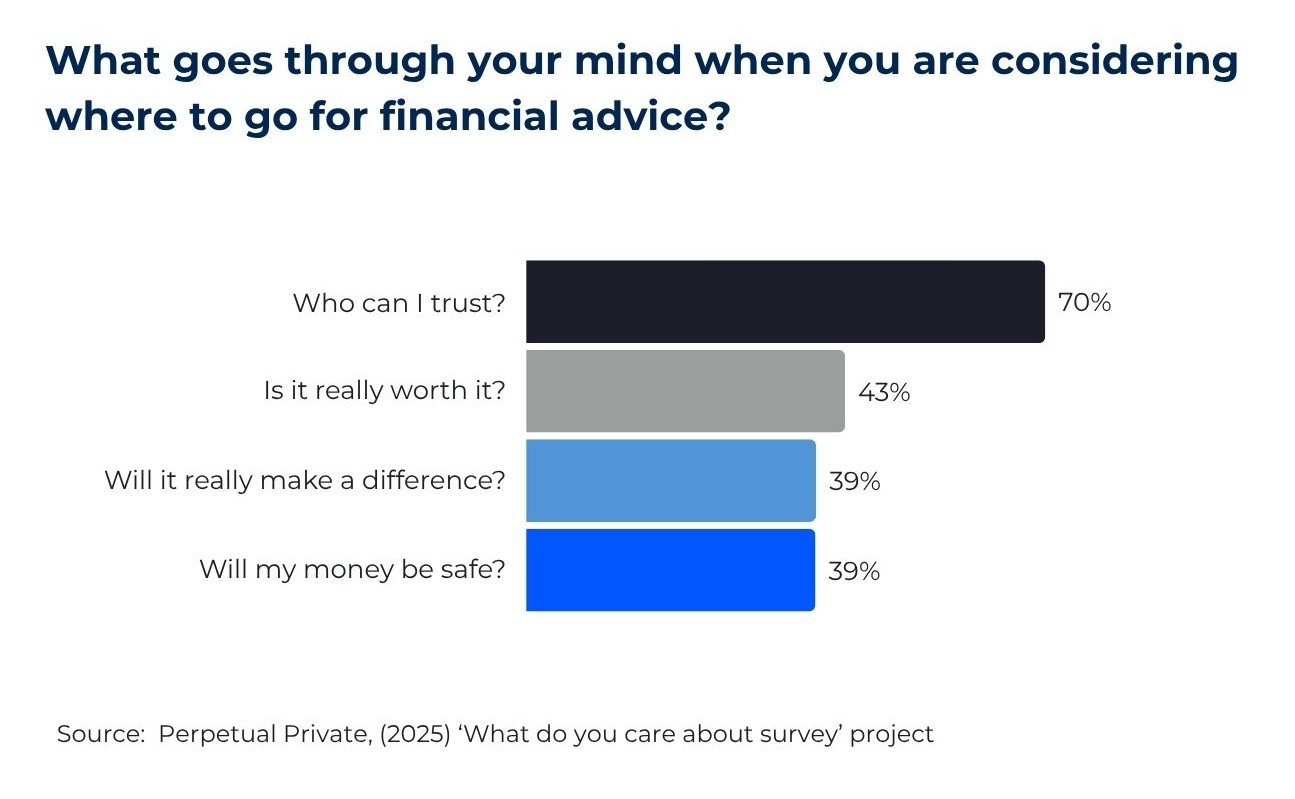

Being mindful of the type of partner you might be looking for, there remain some fundamental questions that many women seeking an adviser want answered.

As Elysse Lorenti, Senior Financial Adviser at Perpetual Private, explains:

“The majority of questions are around affordability. Can I afford the life that I want in retirement? Can I afford to gift money to my kids? How much should I be living off to be able to afford everything I want?

It’s very hard to have perspective and financial clarity when you are caught up in the ins and outs of your daily life. An adviser can be objective and provide you with the clarity to see things clearly. We break it down, defining what clients want, working out if it is realistic and affordable, and then help them understand what they need to do to achieve it all.”

Making a lasting choice

Women who have an adviser – or are considering advice – express the need to plan for the future and enjoy a feeling of peace of mind as the primary reasons for seeking advice.

There are parallels between long-term financial goals and long-term personal goals. A great adviser will be sure to understand more than just your financial situation because ‘living comfortably in retirement’ involves a lot more than having enough money. It’s about feeling secure, staying healthy, and having the freedom to live life on your terms.

That’s why conversations about financial planning often go hand in hand with broader discussions about wellbeing. “I believe wellness isn’t just about physical and mental health – it also includes financial health and wellbeing,” says Elysse Lorenti. “When you feel secure financially, it can support other aspects of your life. That’s why great advice goes beyond numbers; it’s about understanding your goals, your values, and what living well means to you.”

A great adviser listens to, understands and appreciates your vision for your future, helps you shape it into a plan, and guides you toward making it a reality. And once you’re on your way, there’s always time to adjust the dials.

So how do you find an adviser who’s right for you?

Australian women seeking advice have some more practical questions that need answering first.

Start by talking to friends and family about their experiences, search for companies that have a specific focus on providing women's advice and read what their advisers have to say about what they offer. Check whether any of your questions are addressed by what they say.

And when you do sit down with a prospective adviser be equally conscious of both what they are saying and how you are feeling.

The right adviser won’t just offer financial expertise - they’ll offer clarity, objectivity, and a genuine understanding of what matters most to you.

Take the first step toward finding an adviser who understands what matters most to you - visit Advice for Women.

* Perpetual "What do you care about? Project 2024-The Mind Edition"