History shows that share markets always rebound. In spite of the recent unnerving plunge, it’s one sound reason for investors to hang in for the long haul, says Perpetual Private National Investment Specialist Andrew Garrett. In the interim, some smart buys await those keen to boost their portfolios.

On ‘Black Monday’ in late October 1987, the US Dow Jones index plunged by 22%.

A day later in Australia, the All Ordinaries Index fell 25% and had lost more than 40% of its value by the end of that month in an astonishing crash over two weeks.

By 1993, however, the Australian market index had reclaimed all of the ground it had given up, in around six years.

It was a pattern repeated in the Global Financial Crisis, when the All Ordinaries lost around half of its value over the period between November 2007 and March 2009. By the first half of 2019 the market had regained all of those losses and reached its new high in February this year – before the economic disruptions of the COVID-19 pandemic saw history repeat itself, again.

However, those salutary examples from investment history were forgotten by many market players in the knee-jerk reaction to the pandemic crisis, as the Australian market slumped 37% in a month in March.

By mid-May, it had begun to regain ground, and had recovered to be down 24% off its high.

Selling begets panic

History holds many a key lesson for long-term investors, says Andrew Garrett, National Investment Specialist at Perpetual Private.

Don’t panic – those who do are likely to lose money, both when they sell and also when they decide to buy back in again.

“For long-term investors, the best approach is to keep the faith and understand that markets will rebound,” says Garrett. “What we saw recently was what we have seen before in a self-fulfilling cycle, where selling begets indiscriminate panic selling, as we saw stocks that have minimal direct impacts from COVID-19, sell off at the same pace as areas of the market that are heavily impacted.”

Already, Garrett sees signs of a market rebound, as central banks and governments across the world take measures to protect the economy. And, as market optimism returns, he expects a shorter-term recovery over the next 12 to 18 months.

Garrett makes the point that not many investors are fortunate enough to take their profits at the top of the market, and that the majority rush for the exits after the market has begun to fall.

There is only ever a very short window before there is no point in selling out, he explains. Joining the stampede can only accelerate the falls, and crystallise losses to superannuation and investment portfolios. After selling down, re-allocating to more “defensive” assets is not always effective because, by the time many turn their attention to assets, such as fixed income, they have become more expensive.

Long-term horizons

Long-term investors should take at least an eight-year horizon when they look at the market, according to Garrett.

“It used to be a neat eight years, because under previous thinking that was the length of a business cycle, but it is possible for this to be extended out to around 10 or 12 years now, based on the post-GFC experience,” he says.

Investors can be comfortable that rolling 10-year returns are rarely negative. “Investing on a 10-year-plus basis you are unlikely to lose money if you are appropriately allocated and you will outperform inflation.”

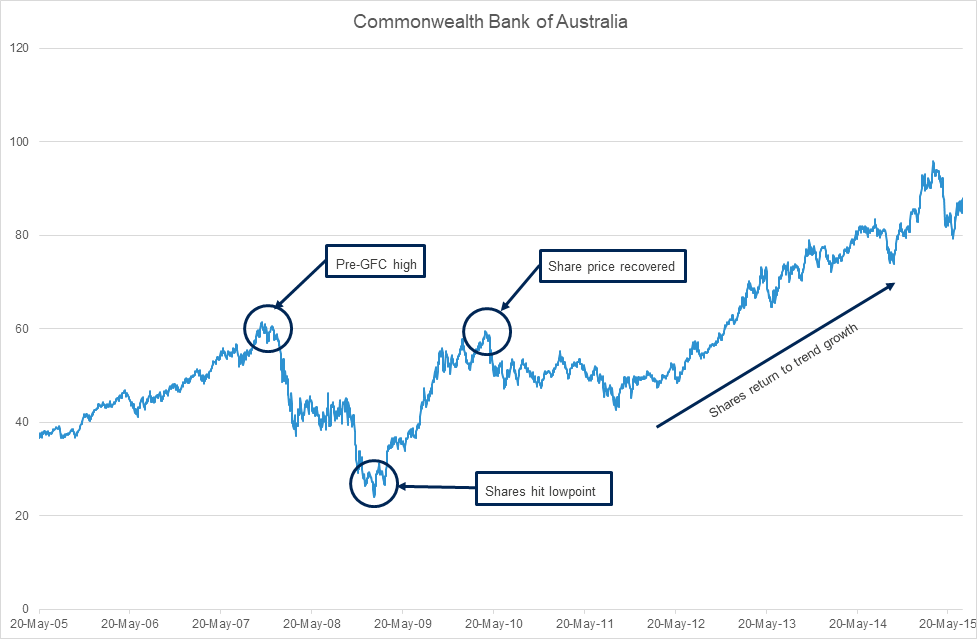

A look at Australia’s largest company by market capitalisation, the Commonwealth Bank of Australia (CBA), shows that while investment might be a roller coaster, those who stay on for the ride are rewarded.

CBA shares were around AUD 60 in November 2007 before the GFC broke. They then slumped as low as AUD 24 by January 2009. By April 2010, the stock had recovered almost all of its capital losses before powering ahead to AUD 90 by April 2015, providing capital gains and a healthy stream of dividends along the way.

Source: Perpetual Private, May 2020

Source: Perpetual Private, May 2020

Time to get active

The current market offers fresh opportunities and is, in many ways, less risky than the record-setting February 2020 market.

“Three or four months ago many people would have felt much better putting money into the market, but now the market is 20% or so cheaper than it was, and the future is exactly the same. The crisis was always coming, but was largely unforeseeable at the turn of the year.” Garrett observes.

“If you look at it that way, the bull market was riskier and people were prepared to take on the same levels of risk, with a lower chance of return, than they are post crisis.”

Investing now makes sense, Garrett argues: “Your future returns will actually be higher because the market is cheaper, so there is an opportunity – if your capacity allows – to increase your investments right now.”

He also believes that now is the time for an active investment approach, rather than a passive approach which seeks to track the major indices. “Index trackers are going to ride the most heavily weighted stocks from last year, and we would argue that the world has changed,” he says.

“Investors have been happy with passive investing in the recent past because it is cheaper and has delivered results, but in the current market we see quite a bit of dispersion and differentiation. There’s a good opportunity to buy assets if you do the research and understand what sectors and which companies are going to do well in the post-COVID world.”

Total perspective

In considering stocks, Garrett urges investors to look at total returns, a combination of both capital growth and dividends.

Some stocks, such as blue-chip banks and miners, offer significantly higher dividends than a company such as biotech giant CSL, where dividends are low but five-year total return for the shares has been higher than 250%, mostly driven from share price gains.

Good arguments exist on both sides of the dividend versus capital growth debate, but Garrett backs the ‘total returns’ approach. “A company that offers higher dividends may have better capital management, but it also means that they don’t retain and re-invest a proportion of their profits, which begs the question on where growth is going to come from,” he says.

CSL, meanwhile, is a great example of a company that has invested in the future and has delivered excellent growth. So whilst both approaches have their merits, investors who don’t have a specific need for income from their investments, should consider both forms of return (capital and income) when selecting assets, Garrett concludes.