When people planning their retirement talk to us about managing their finances their eyes light up when the conversation turns to travel. After years of hard work and family commitments, people want the freedom to jump on a plane and see the world, but the devil is in the finances. Will it be a tour of Paris and London or Geelong and Lithgow?

Australians favourite overseas holiday destinations

Because travel is such a priority for retirees, we wanted to find out more about the travel habits of Australians. So, we asked 2,700 people as part of Perpetual’s How Do You Feel project. By far the most popular travel destination was Asia, accounting for 47% of overseas holidays over the last 12 months.

Then we asked where people would go if they could choose anywhere in the world. The destination of choice was Europe at 35%, followed by North America at 13%. Asia dropped to 9%.

It’s little surprise that travel destinations are determined by budget – Australians would prefer to travel to Europe but choose Asia because it is less expensive.

In much the same way, the size of your nest egg in retirement will determine the stamps you have on your passport.

How healthy is your travel budget?

When people seek financial advice in preparation for their retirement, the conversation is often about protecting their wealth, rather than building it. The size of their retirement income has already been determined. People want advice on the best way to manage and access their money:

- How can I receive regular retirement income to meet my monthly living expenses?

- What about my superannuation – should I take it as a lump sum?

- I don’t want to use credit cards to pay for travel – how can I have access to cash for discretionary spending?

- Should I keep my self-managed super fund?

- Should I sell an investment property to fund my lifestyle?

Croissants or chicken parma?

We know the conversation shouldn’t stop there. Important considerations such as planning for rising health costs later in life and options to help your children financially, if overlooked, could mean the amount of discretionary spend you have for travel may be a lot less than anticipated. It can be a sobering conversation as people tend to overestimate their level of retirement income and underestimate how long the money will need to last.

Are we telling you to swap your plans for croissants in Paris with chicken parma in Patonga?

Quite the opposite, provided you seek financial advice sooner in life.

The best holidays are planned in advance

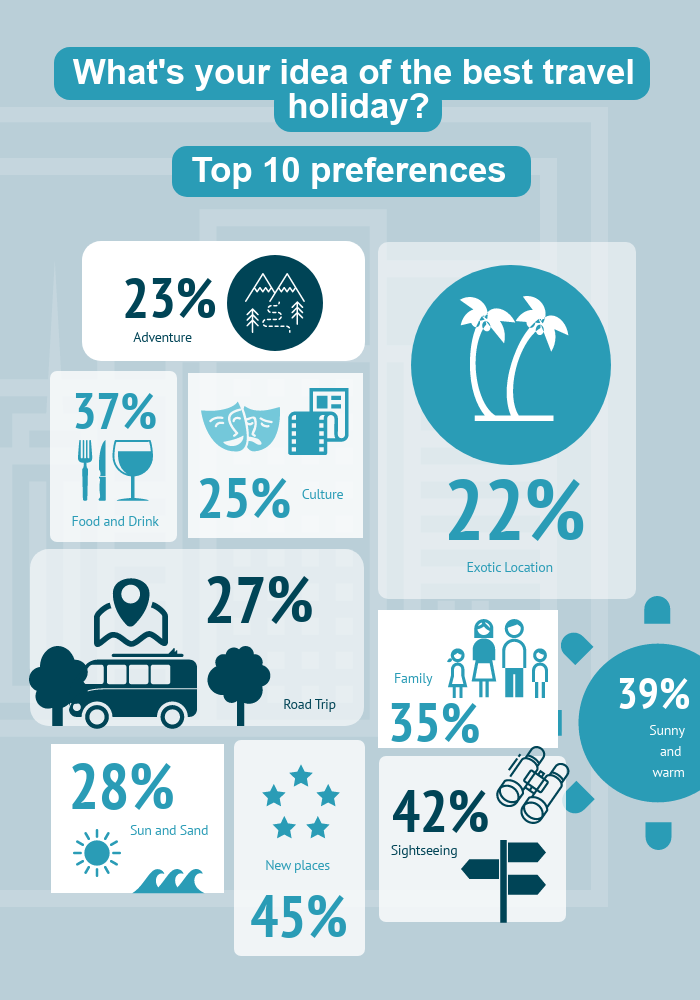

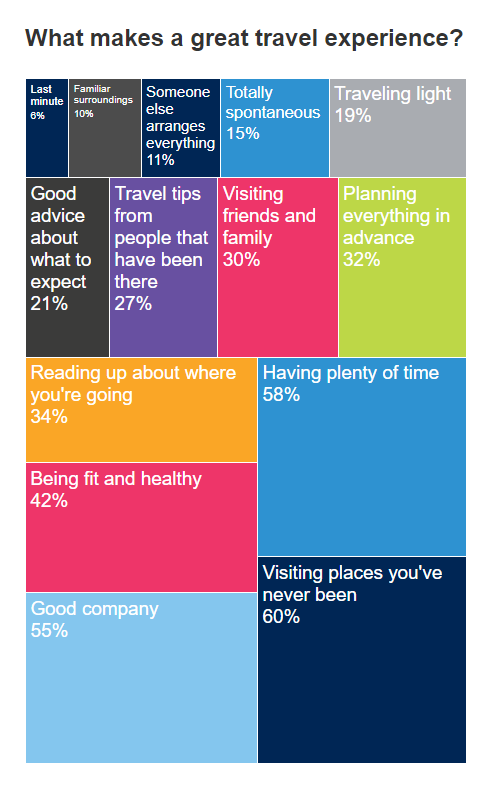

Let's return to our research for some inspiration.

When we asked people what makes a great travel experience, 34% said researching where you’re going and 32% said planning in advance.

Now there’s an analogy for achieving financial freedom in retirement – early planning with a clear destination in mind.

Here are some of the reasons why an earlier conversation can help you generate more retirement pocket money for things like travel:

- Superannuation – Super is a tax effective way to fund your retirement but recently introduced caps make it harder to top up before you retire. You need to plan contributions over a longer period.

- Growth – You can take more investment risk for greater potential gain when you are younger because time is on your side – you can ride out periods of market volatility rather than being forced to sell your investments for retirement income.

- Diversification – Australian retirees can sometimes concentrate their investments in a single asset class – like the perennial favourite residential property. This increases risk because they are more exposed to a downturn in the property market – most of their eggs are in one basket. An experienced adviser can help people diversify – or spread their risk – by investing in a broader range of areas. This could include shares in a variety of industry sectors both domestically and around the world.

You may delay, but time will not. Benjamin Franklin

The right financial advice can be life changing. By seeking advice earlier in life, you will have more time to build your wealth and achieve financial freedom in retirement. That’s more pocket money for the finer things in life – like travel.