You’re starting to think about retirement. Someone suggests, “You should talk to a financial adviser.” But what does that actually mean?

The American architect Robert Stern once said, “The dialogue between client and architect is about as intimate as any conversation you can have, because when you're talking about building a house, you're talking about dreams.”

It’s no different with financial planning. While a retirement strategy may be less exciting than the garden of your dream home, the result is the same – a life more full of the things that make you happy.

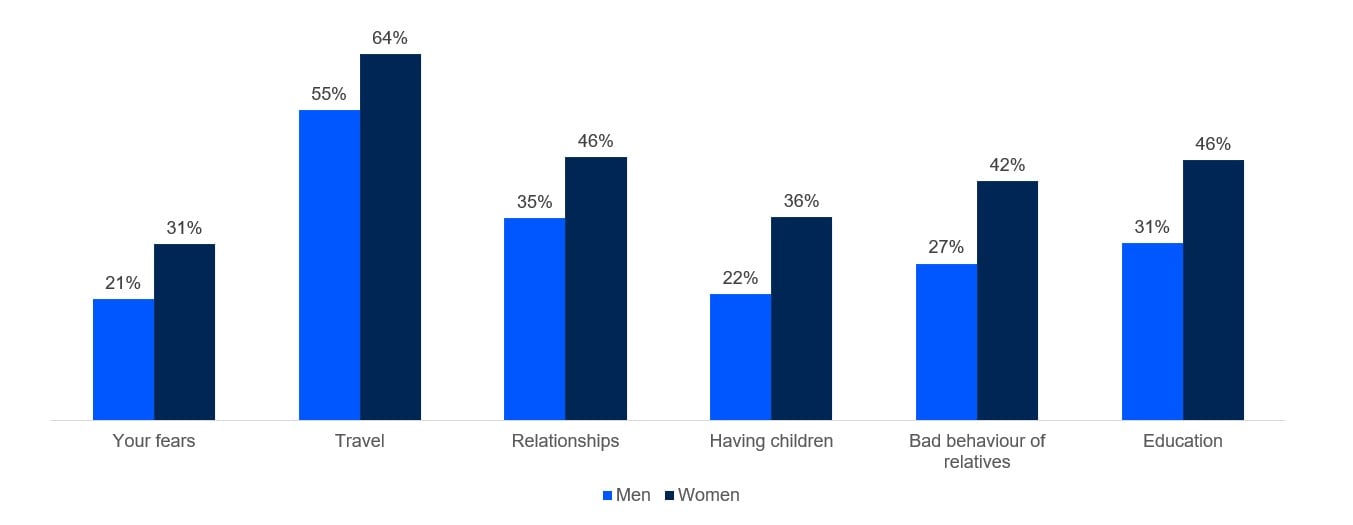

In 2023 we asked Australians which topics they are comfortable talking about with family. Women are far more comfortable talking about most things and the chart below shows the topics they are much more comfortable talking about than men.

Topics women are more comfortable talking about with family than men.

Source: Lembit, G., (2023) 'What do you care about: The Life Project', Perpetual Client Insights September 2023.

Getting to your dream

There are many elements to a good financial plan – setting goals, financial strategies and products, regular reviews and much more. But according to Perpetual Private’s State Manager (NSW, ACT), Fotini Mastrogianni, the most important element is the conversations an adviser has with their client.

“Unless you understand a client, you can’t help a client,” says Fotini. “We put a lot of effort into those early meetings because if we get them right the rest of the process – the strategy, the products, the results for the client – flow naturally.”

So what are the elements of a good client/adviser conversation?

Space and time

“My clients are smart, highly-educated people,” says Perpetual’s NSW Advice Manager Daniel Walsh. “They’re business owners, executives, financially successful professionals. But they don’t spend all day looking at markets and tax legislation and super strategies. At Perpetual, we schedule client meetings that are frequent enough to thoroughly address their needs, yet mindful not to disrupt their daily lives.

Many clients come to Perpetual because they have complex financial situations. Sometimes it’s a mix of business and personal finances, at other times it’s advice that spans generations or involves multiple family members.

Daniel and Fotini both have clients who are the fifth generation of a single family to get financial advice from Perpetual. That’s not just because of Perpetual’s 130 year history.

It’s because advisers are trained to understand and work with families. “We often have wife, husband and adult children in a room,” says Fotini. “There’s a real art to making sure all points of view are heard and everyone’s wants and needs are addressed.”

Meet Natalie

Natalie was first introduced to Perpetual by her 94-year-old neighbour.

“She had lived on her own for over 20 years, and as she became less able, Perpetual evolved to meet her needs.”

When Natalie first spoke to Perpetual, it was a conversation about life, not finances. That’s where good financial advice should start – with an understanding of the person and the life they want to lead. Financial advice is simply the way to achieve it.

As Natalie observes in this interview, “Really, it’s about creating a lifestyle.”

Keep on talking

The other element of a conversation with a Perpetual adviser is that it changes over time. The Perpetual advice relationship always includes a regular annual or six-monthly review and allows for constant catch-ups if there are questions or issues a client needs to discuss.

Over time those conversations change. At the beginning of my journey with a client, we’re often talking about a financial conundrum triggered by a life event. This event may be an inheritance, a business decision or separation. But over the longer term, those conversations focus more on people – on children and grandchildren and helping people through philanthropy.

The true power of conversation lies in its ability to evolve alongside your changing financial needs and priorities. Through ongoing, candid discussions with your financial adviser, you can ensure your advice remains tailored and relevant, empowering you to confidently navigate life's ups and downs.

These conversations create a dynamic feedback loop - as you share your evolving goals and experiences, your adviser can fine-tune their guidance to keep you on track towards financial wellness. It's this collaborative partnership, built on trust and open communication, that allows your plan to grow and adapt alongside you.

So don't underestimate the value of a good chat. By embracing the beauty of conversation, you unlock the key to financial security that can withstand anything life throws your way.