Separating from your long-term partner is incredibly difficult. Amid the rollercoaster of emotions during the process of separation and divorce, many women suffer a longer-term hit to their confidence and self-esteem.

Perpetual’s 2023 ‘The Life Project’ study for which we interviewed 3000 Australians showed that Divorced/ Separated or Widowed women are much more likely to feel stressed and anxious than other Australians. Yet they are also much more likely to feel hopeful (42% compared to 32% of Australians).

The emotional toll of separation makes it harder to deal with the practical difficulties and complexities that come from separating two lives. For women who left it to their partner to look after the ‘money side of things’ during their relationship, making the right financial decisions at this time is a particular challenge.

According to Carolyn O’Reilly, Partner at Perpetual Private, many women post separation find themselves confronted with big financial decisions that for the first time need to be made on their own.

“Often in a relationship one party is responsible for more of the financial decision making. This means that many women who are recently separated or divorced may not have previously been in control of their own finances.”

Women care more about money and finances, but have less experience

Our research also found an unfair anomaly in men and women’s attitudes and experience towards finance and investments. The findings showed that while women (78%) are far more likely than men (64%) to care ‘a lot’ or ‘more than anything’ about their finances, they are significantly less likely to feel confident about managing their finances. Some 54% of women say they are confident or highly confident’ in managing their finances compared to 63% of men.

Unfortunately, a separation or divorce is just about the worst possible time to take a crash course in finance and investments to gain the confidence and expertise needed to make these important decisions.

Sharon Parker, Lead Partner at Fordham, a specialist part of Perpetual, suggests that women who find themselves in this situation should, as early as possible, seek expert advice to try to understand their financial position:

“It’s very hard to go through a relationship breakdown and try to gather financial information at the same time. I think the best way is to find someone you can trust, who is able to translate complex financial information into something you can understand. Then you need to ask really good questions and keep asking them until you understand.”

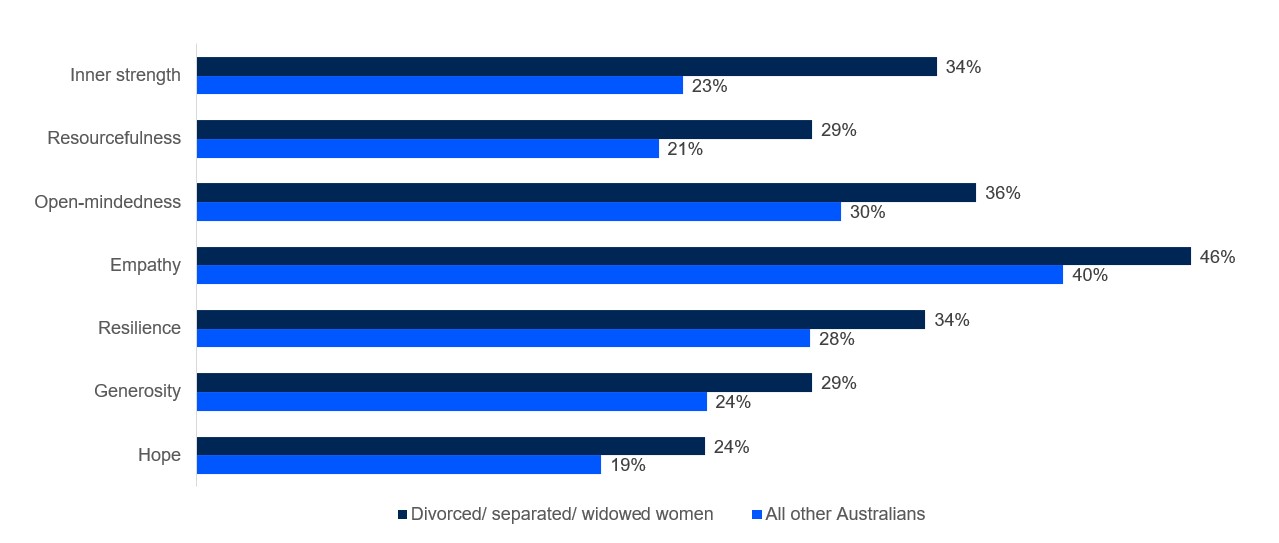

Separated women have the right qualities to take control

The good news for women in this situation is that our research shows divorced and separated women have the right qualities to take charge of their finances. While the timing may be bad, they are more likely than other Australians to have the inner strength and courage (as well as a range of other great qualities) to overcome the personal emotional toll of separation and also make the right financial decisions.

Source: Lembit, G., (2023) 'What do you care about: The Life Project', Perpetual Client Insights September 2023.

Financial steps to take during and after a separation or divorce

After taking stock of your situation and looking after your immediate financial needs (things like general living expenses and mortgage repayments) Carolyn advises women to put together a budget and to seek financial advice. A budget is crucial, as it’s likely that your financial situation will have changed significantly. After that, Carolyn suggests looking at your short, medium-term and long-term financial plans, including any risks that you might be exposed to.

Some areas particularly worth looking at are:

- Your will, estate plan and powers of attorney. Work with a solicitor to make sure they’re still fit for purpose.

- Your bank accounts, especially joint accounts and joint credit cards, to decide whether they meet your current and future needs.

- Insurance (life, TPD and income protection). You are likely to need to change it to reflect your new situation.

- Family trusts. If you have a family trust, is this trust still a relevant structure for you? If you don’t have a trust, is it something you should consider opening to receive assets as part of the financial settlement? Trusts can both minimise tax and protect assets from future financial exposure.

Find more detail on these financial steps in this article.

Every separation is different – what don’t you know?

Of course, these are general guidelines. Every person our advisers and accountants talk to has different needs and will need the advice of different experts. As Carolyn says:

“You can’t know what you don’t know. Recently, one of my clients, going through a separation also needed to return to work. This meant it was important to consider whether income protection insurance was appropriate. In this case, the client also had dependants and debt so other types of personal insurance were also considered like life, trauma and total and permanent disability insurance.”

Sharon spent time with her client reviewing her whole financial plan, including how her new family unit was going to meet its future income needs, and then longer term looking at how she would manage her finances to meet her retirement. Sharon worked as her client’s key accountant and adviser throughout, drawing in other experts, such as a financial adviser and investment specialist, when required. It’s this consistent support and expert advice throughout the whole separation process that Sharon says her clients find most valuable:

“A relationship breakdown is emotionally difficult and financially damaging. During a time like this it’s important to have a trusted adviser and accountant beside you to guide you through it. You need someone to identify the issues and put together a strategic review and plan which is relevant for your individual circumstances. By engaging an expert, you’re not on your own. Your adviser and accountant will help you make informed decisions that are in your best interests.”

Source: Lembit, G., (2023) 'What do you care about: The Life Project', Perpetual Client Insights September 2023.