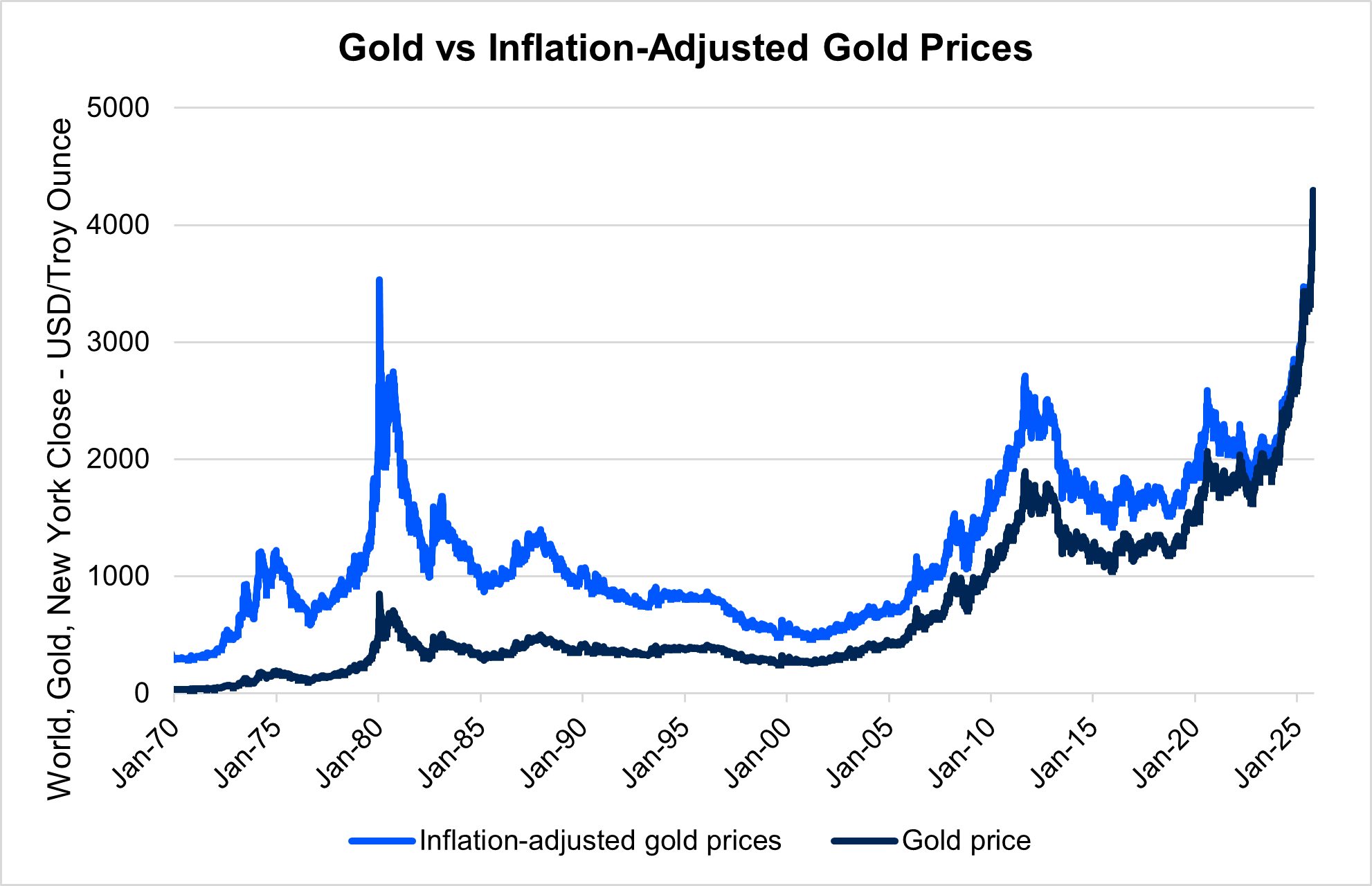

Gold is back in the headlines. After years of quiet trading, the yellow metal has surged to record highs in 2025, gaining over 50% and reaching over US$4,000/oz, its highest inflation-adjusted price in history, surpassing even the 1980 peak. For advisers, the question isn’t whether gold has done well, but whether it deserves a place in client portfolios. Understanding what drives gold, when it performs, and what could keep it rising is central to informed asset-allocation decisions.

Source: Macrobond. LBMA (London Mullion Market Association), U.S. Bureau of Labor Statistics (BLS). Perpetual Private

What is gold, in investment terms

Gold is a physical commodity, a durable asset of limited industrial use. It generates no coupons, dividends or earnings making the valuation of gold more art than science. In fact, when accounting for storage costs, gold has a negative carry over time.

What drives the price

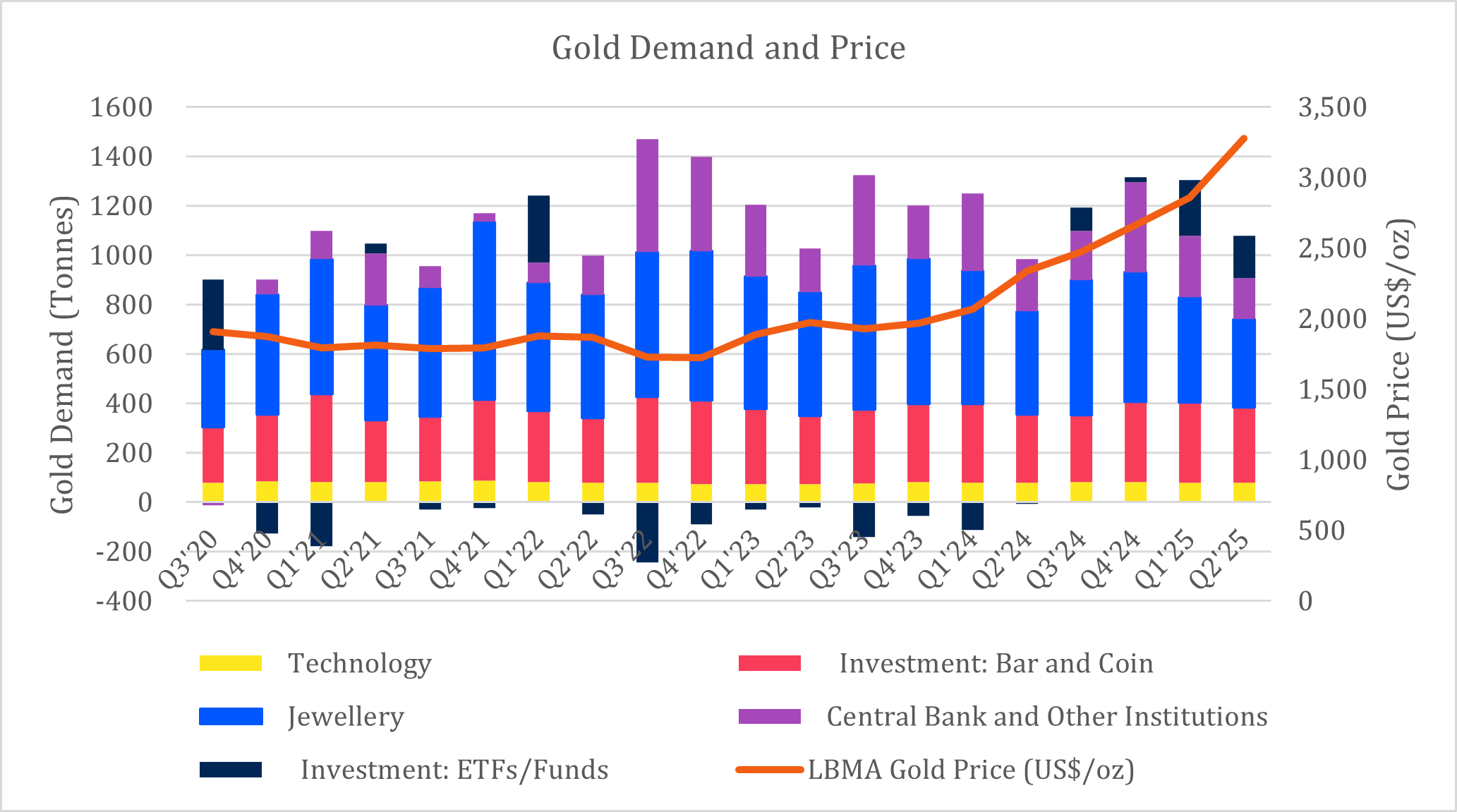

Gold’s value is shaped by macroeconomic conditions, geopolitics, and investor sentiment. Central-bank activity has been a major driver in recent years, with official sector holdings now accounting for about one-fifth of all gold ever mined . Following Russia’s invasion of Ukraine and the freezing of its USD assets in 2022, central banks (particularly in China, India, and Türkiye) stepped up gold purchases to lessen their dependence on the US dollar amid rising geopolitical uncertainty.

This renewed official-sector demand has reinforced gold’s appeal as an alternative to traditional currencies, a theme also visible in the rise of cryptocurrencies. Both trends reflect investor unease about monetary stability and the long-term value of paper money. Yet this narrative faces challenges: if confidence in the US was truly eroding, the dollar would be weak and long-term bond yields would likely rise meaninfully. Instead, yields have eased in recent months, though from relatively high levels, and while the trade-weighted US dollar has fallen about 10% this year, it remains strong by historical standards. Overall, this points to a mild loss of confidence in the dollar rather than a collapse, suggesting the “debasement” trade may be driven more by sentiment than substance.

Alongside central banks, retail and institutional investors have expanded their exposure to gold, with record inflows into ETFs in recent years driven by inflation fears, volatility, and a search for safe, tangible assets. However, more recently this rally appears increasingly driven by developed market retail investors, what market participants often characterise as "hot money." Unlike the structural, long-term positioning typical of central bank reserves, retail flows tend to be momentum-driven and prone to rapid reversals.

Beyond investment demand, gold retains steady support from jewellery and technology applications, which provide a stable but smaller base of physical demand. Combined with constrained supply growth and structural buying from central banks, these factors help underpin long-term value. In the medium term, however, real interest rates, the US-dollar trend, and global risk appetite remain the dominant drivers of price direction.

Source: ICE Benchmark Administration, Metals Focus, Refinitiv GFMS, World Gold Council as at 30/06/2025

When gold performs

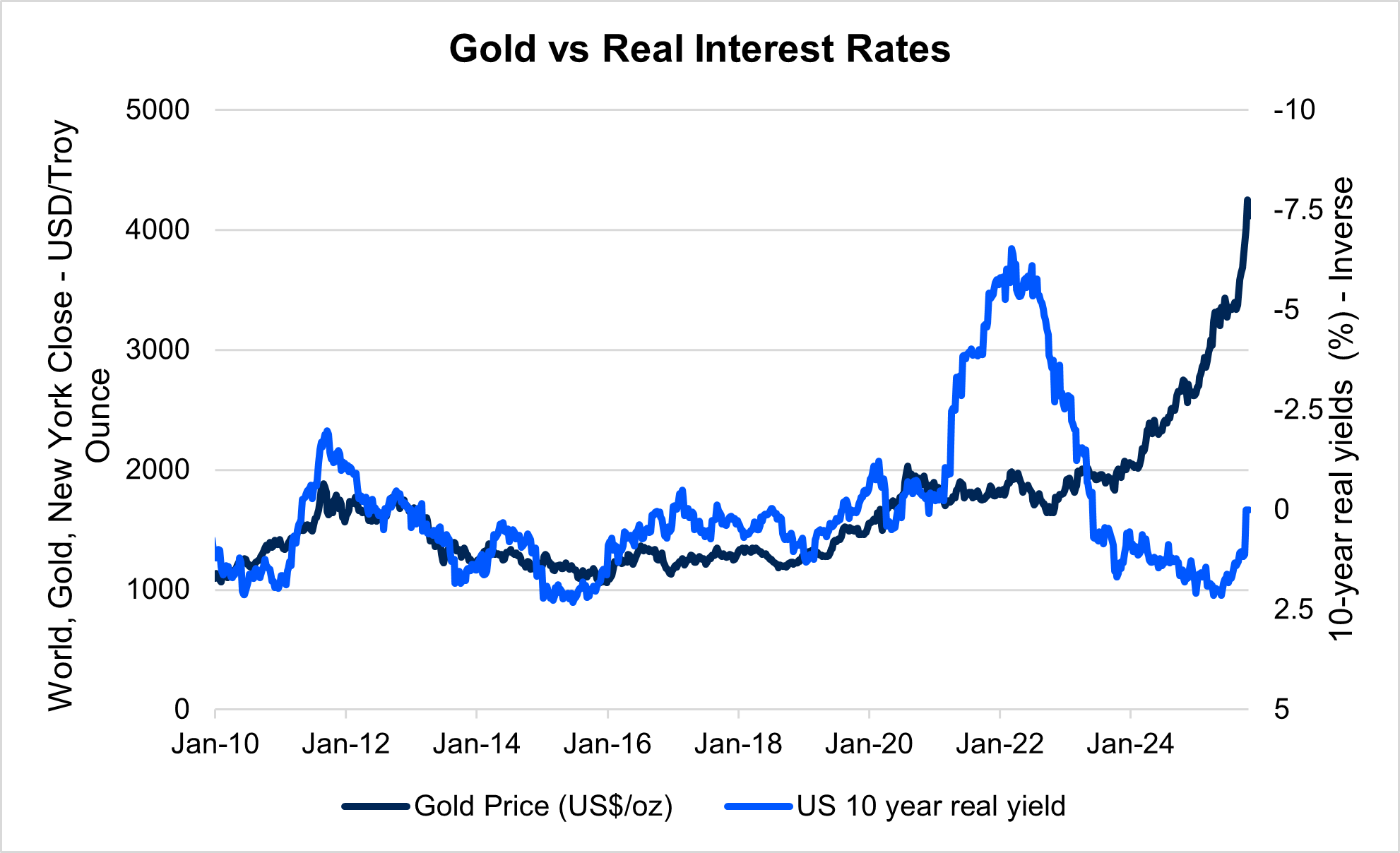

Gold’s performance is cyclical and has had long periods where prices have been largely flat as well as periods where the value has dropped significantly. It has typically performed best in low real-rate, high-uncertainty environments, and poorly when real yields rise or risk appetite returns. However, gold has recently diverged from its historical relationship with real yields, continuing to rally even as real rates have risen from deeply negative levels. When an asset disconnects from its long term relationships, speculation and momentum tend to dominate, resulting in conditions that rarely persist.

Source: Macrobond. Perpetual Private.

History also offers cautionary lessons. After surging during the stagflationary 1970s when gold appreciated from US$43/oz to US$850/oz, gold lost 62% of its value in just 2.5 years when the US Federal Reserve tightened policy. More recently, gold declined by 30% in 2012–13 after its post-GFC run-up as markets normalised.

What you’d need to believe for gold to continue to rise

For gold to maintain or extend its gains investors would need to believe that many of the conditions which propelled it higher over the past few years will persist or intensify.

- Real interest rates remain low or fall further.

A feature of the rally has been expectations of rate cuts from the US Federal Reserve and other central banks. For gold to keep rising, markets would need to assume that inflation will remain sticky while policy rates are reduced keeping real yields negative. If the Fed instead keeps policy tight to reinforce its inflation-fighting credibility, gold’s momentum could fade. - Inflation pressures prove more durable than expected.

Sustained wage growth and elevated energy prices could keep inflation higher for longer, especially if supply-side shocks drive another round of cost increases. Such conditions could bolster gold’s role as an inflation hedge. - Geopolitical uncertainty continues to rise.

Persistent instability in the Middle East, tension in the South China Sea, and strained US-China trade and technology relations all contribute to investor unease. A contested US election or renewed fiscal brinkmanship could further undermine confidence in the US dollar and Treasury market, reinforcing gold’s “safe-haven” appeal. - Central banks keep buying aggressively.

Emerging-market central banks (notably China, India, and Türkiye) have been diversifying their reserves away from the US dollar. For gold to keep rallying, that trend would need to continue or accelerate. However, central bank purchasing has slowed over the past few quarters, and with central banks already holding significant allocations, the marginal impact of incremental purchases is likely diminished. - The US dollar weakens materially.

Gold and the dollar have an inverse relationship because gold is priced in dollars. That means:

• When the US dollar strengthens, it takes more foreign currency to buy the same ounce of gold so demand from non-US buyers falls, pushing the gold price down.

• When the US dollar weakens, it takes less foreign currency to buy gold and so demand rises, pushing the price up. - A recession emerges and risk assets sell off

A global or US recession would likely boost demand for gold as investors seek safety from falling equity markets and weaker corporate earnings. In that environment, expectations for interest-rate cuts would rise, real yields could turn negative again, and risk aversion would lift defensive assets.

In short, for gold to sustain its climb, investors must believe that the current blend of low real rates, geopolitical risk, and dollar weakness will persist well into 2026. Any reversal in these conditions such as firmer growth, higher real yields, or easing global tensions would make it difficult for gold to justify further gains and could lead to significant losses.

Perpetual view

Whilst gold could continue to rise in the short term (supported by geopolitical tension and investor caution) the outlook now appears finely balanced. Gold is difficult to value but many of the forces that have driven its strong performance look less likely to strengthen further.

Inflation is easing across most developed markets, and central banks remain wary of cutting rates prematurely. The US Federal Reserve and ECB have signalled they’ll keep policy restrictive until inflation is firmly contained. Meanwhile, the US dollar appears to have stabilised as services activity and broader risk assets remain resilient. Central-bank gold purchases have also moderated from the record pace seen through 2022–24.

A deeper slowdown or outright recession would likely see gold rise again as investors seek protection from falling equities and potential rate cuts. However, we do not believe we’re at that point yet; global activity has softened but remains resilient. Indeed, the IMF's Global Economic Outlook sees growth being meaningfully lower than previously expected (3.0% vs 3.7%) but still robust.

For now, we believe that direct gold exposure is best managed within a hedge fund exposure where it can be employed more tactically rather than strategically. Timing and macro sensitivity are key, given gold’s dependence on real rates, currencies, and sentiment. With equities still climbing and growth holding up, traditional diversifiers such as fixed income, cash, and select alternatives offer more predictable defensive characteristics. Gold remains a useful hedge against shocks, but less compelling as a core holding until the macro environment turns decisively weaker.