Credit is one of the most reliable and repeatable sources of above-market returns, argues Perpetual’s head of fixed income Vivek Prabhu. In this article Prabhu explains why – in the hands of a skilled active manager – credit investing can achieve better fixed-income returns than government bonds alone.

- Credit spreads offer a potential source of alpha

- But you need to know when to buy and when to de-risk

- Find out about Perpetual Diversified Income Fund

Credit is the one of the “most reliable and repeatable” sources of above-market returns for fixed income investors – as opposed to pure fixed-interest government bond portfolios.

That’s the view of Vivek Prabhu, Perpetual’s head of fixed income.

Credit mostly refers to government debt issues (bonds).

Corporate bonds are usually rated by agencies such as S&P and Moody’s and tend to offer a higher yield (or interest) rate to compensate investors for default risk.

By comparison, government bonds are considered higher quality (lower risk) and therefore offer lower yields.

The difference in yields between government bonds and corporate credit is where a skilled active manager can find “alpha” or above-market returns.

“Historically, credit premiums have overcompensated for default risk,” says Prabhu, who manages Perpetual’s Diversified Income Fund.

“Provided you’ve done your homework properly and accounted for default risk, you usually have a very clear line of sight as to the end outcome.”

How to manage risk when investing in credit

“As credit risk is asymmetric, you've really got to do your job well on accounting for that downside risk, however,” says Prabhu.

Perpetual’s credit and fixed income team has a meticulous and well-practised investment process which examines individual issuers and their industries.

That includes an annual review cycle (bottom up analysis) for corporate investment-grade credit and ongoing market surveillance.

The investment team refreshes their credit outlook (risk appetite) fortnightly and also form a matrix of investment preferences by industry sector, credit rating and tenor (maturity).

Each portfolio manager wears three hats he says: PM, credit analyst and dealer.

“In an over-the-counter market like fixed income, it's important to have your finger on the pulse. That can give you early warning signs that other managers may not get who aren't so active.

“Our active management means we are regularly facing the market and can see subtle changes in liquidity or pricing.

“This can provide an early warning sign as to when market conditions are changing, offering a signal of when to de-risk or add risk.”

When to buy and when to de-risk

As an example, in February Prabhu outlined his strategy for investing in subordinated bank debt – a type of tradeable, unsecured debt issued by banks to raise capital.

“I'd foreseen a strong prospect that ratings agencies S&P and Moody's would upgrade major bank subordinated debt,” he says.

“We continued that overweight position in this fund because I thought there was a strong likelihood of ratings upgrades.

“We published that article on February 7 and right on March 6 Moody's upgraded it from Baa1 to A3.

“Then on April 2, S&P also upgraded it from BBB+ to A-.

“So that position performed really well in April as credit spreads contracted on that bank subordinated debt, reflecting the improvement in credit quality - causing the bonds to appreciate.

Knowing when to de-risk is just as important, he says.

“For example, in terms of my current investment outlook, BBB credits are starting to look pretty expensive relative to more highly rated bonds.

“While BBB bonds are still considered investment grade, you're no longer getting much of a credit premium in comparison to higher-quality single-A rated bonds.

“Why is that? It's because the market is becoming less discerning about risk as it chases return (yield) at any cost as credit premiums have fallen. And there's a lot of cash looking to park itself in credit or fixed income in general.

“I've been rotating out of BBB and high-yield credit because I see that as a key risk for the coming six-to-12 month period.”

“That’s the main thing that's changed in my portfolio outlook and positioning at the moment.

Passive versus active fixed income investing

The rise of passive investing is well known to equities investors. But Prabhu strongly argues against an index-approach to fixed income for several reasons.

First, by their nature, fixed-income index funds can be said to back the losers rather than the winners.

“Passive might work in equities because the companies that are doing well typically have a bigger market cap.”

(The bigger the market cap of a company, the larger its weight in a passive index fund, which means it has a greater influence on fund performance).

“Passive equities funds will build a higher weighting to the winners so to speak – the companies that are growing and getting a bigger market cap.

“But it's actually the opposite in fixed income. With fixed income, the index representation of a particular company or government is driven by how much debt they have on issue.

“As companies or governments issue more debt – and become worse credit quality and more financially leveraged – they actually become a bigger part of the index. “

In addition, the huge pandemic-era debt issuances of governments meant index investors lost exposure to the premium offered by credit issuers, Prabhu says

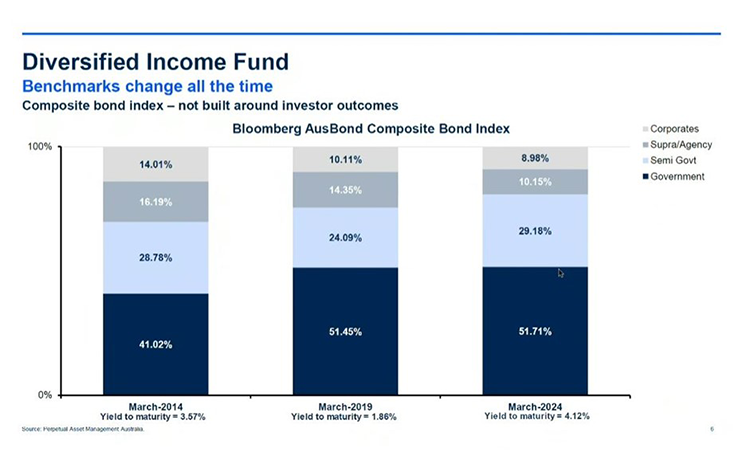

He points to the graph below as an illustration.

“As a passive investor, a decade ago you were collecting a credit yield premium on 14% of the passive replication of the Bloomberg AusBond Composite index benchmark.

“Today corporate bonds represent only 9% of the fixed rate bond benchmark.

“You've been collecting less and less of that credit-yield premium if you're a passive investor as governments have issued more and more debt.

“Of course corporates have issued more and more debt too, but governments have just outpaced them post GFC and post pandemic.

“That’s potentially costing you returns compared to an actively managed fund.

Best opportunities in a decade

“We’re currently seeing some of the best opportunities in fixed income in a decade,” he says.

“Not only are equities or growth assets expensive – but fixed income is offering some of the best opportunities relative to equities.

“You can have your cake and eat it too at the moment, because you can get equity-like returns with the stability of fixed income.

“It should make investors think about their asset allocations. Is this the right time to tilt away from growth assets and into fixed income – because it's looking cheap on a relative basis?”

“And then there is the inflation genie, which people thought was going back into the bottle, but is now a resurgent theme again. “

Stubborn inflation has seen support for the “higher-for-longer” theme as central banks back away from potential rate cuts.

“Floating-rate credit has offered a good hedge for inflation historically,” points out Prabhu.

Find out about Perpetual Diversified Income Fund

About Perpetual’s Credit and Fixed Income team

Perpetual offers a range of cash, credit and fixed-income solutions and are specialists in investing in quality debt.

We take a highly active approach to buying and selling credit and fixed income securities and invest extensively across industries, maturities and the capital structure.

Find out more about Perpetual’s Credit and Fixed Income capabilities

Want to find out more? Contact a Perpetual account manager