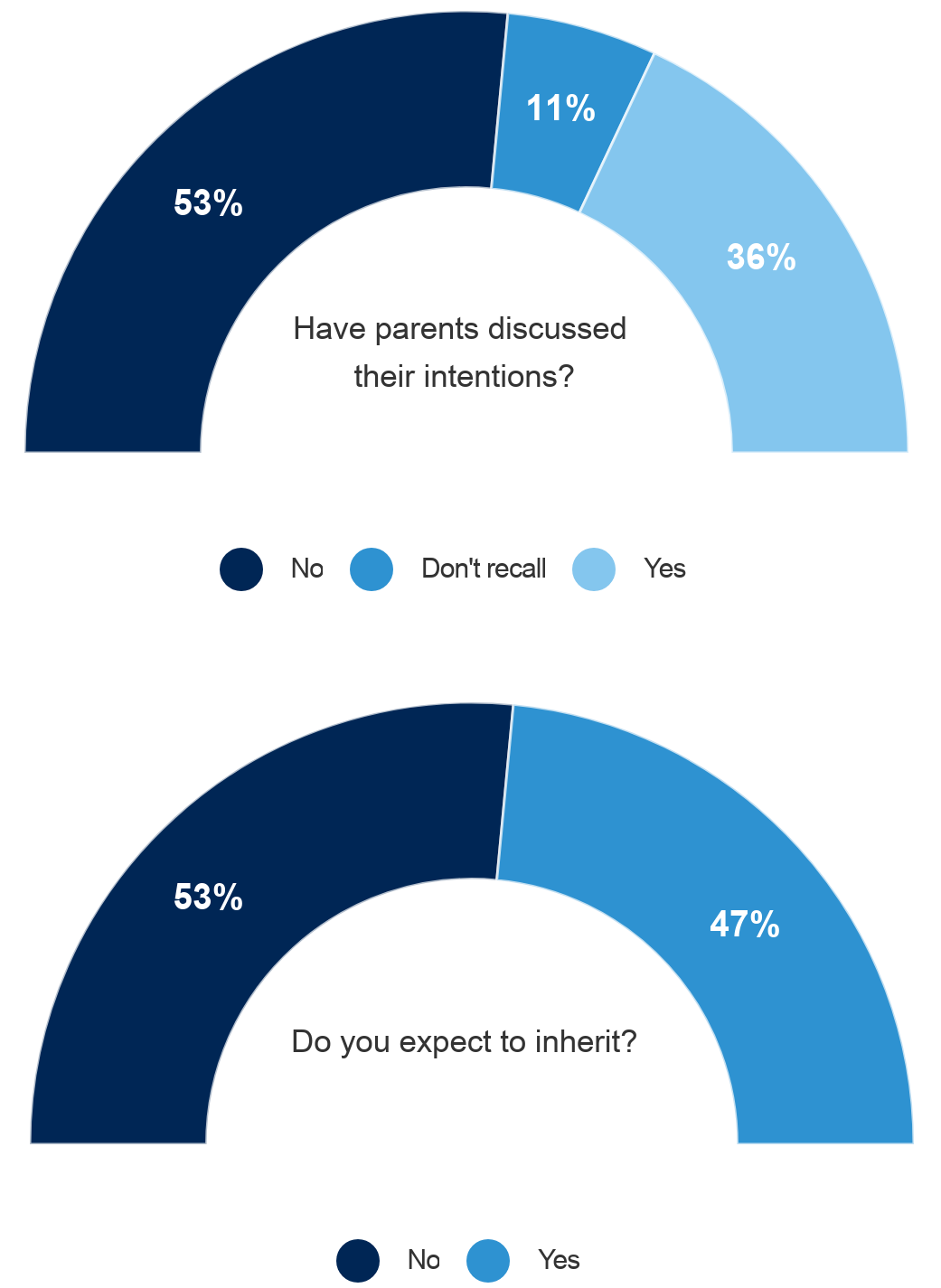

People often say there are two things you should never talk about: politics and religion. But when we talked to 3,000 Australians, we found another — legacy. Only 36% of people have discussed their parents will and legacy with them.*

Source: Lembit, G., (2019) ‘What do you care about’, Perpetual Client Insights and Analytics, released 26 September 2019

It’s remarkable that so many of us are so close to our children, but never talk to them about what we would like to happen to the wealth we’ve spent a lifetime building up. While more than half of Australians expect to inherit, only just over a third have discussed it with their children.

For most of us, inheriting is the single biggest injection of cash or capital we will ever receive. But 1 in 5* of us are expecting to inherit without really being certain we will. For something which can make such a massive difference to our lives — it’s a lot to take on trust.

Who discusses inheritance?

According to our study*, while any family might talk about their legacy, there are some that are more likely to. Families who are close to each other, families that describe their relationship as loving and caring, are 5% more likely to discuss legacy. Happy, close families are also more likely to:

- Receive an inheritance – 10% more likely;

- Be grateful for what they receive – 10% more.*

While it’s unsurprising that close families are more likely to have difficult conversations, there are other factors which make a discussion about inheritance more likely. We’re not sure why, but women are 12% more likely to talk to their parents about their will (42% vs 30%).*

Perhaps they are closer to their parents, or better communicators, or more comfortable talking about difficult subjects?

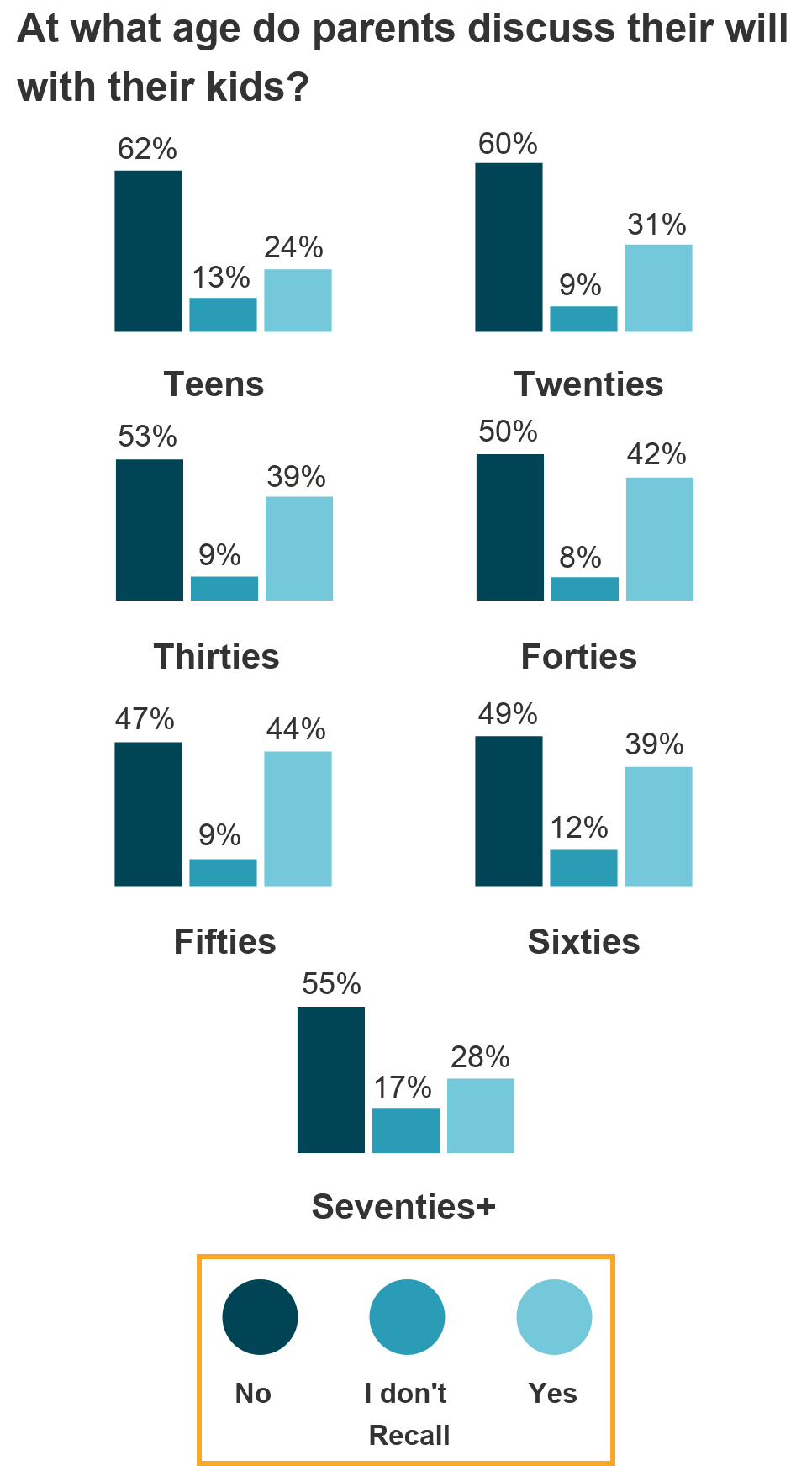

Age is also a factor. By the time children reach their teens, around one quarter* of parents have discussed their inheritance with them. This percentage increases gradually until children are in their 40s and 50s. But if you haven’t discussed it by then, chances are you never will.

Source: Lembit, G., (2019) ‘What do you care about’, Perpetual Client Insights and Analytics, released 26 September 2019

Grateful, happy, surprised or all of the above

Just as everyone is different, so are their reactions to inheriting. While people are most likely to feel grateful, they might also experience a whole range of other emotions including happiness, surprise, relief or disappointment.

While 76% of people are likely to feel grateful for their inheritance, this rises to 86% if you describe your family as happy or close.*

Size also matters, but maybe not in the way you might think.

35% of people feel happy about their inheritance and this rises to 52% if they inherit what they describe as a ‘large’ amount.* Also, the larger the inheritance, the more likely you are to feel excited and relieved.

However, interestingly, the larger your inheritance the less likely you are to feel grateful. 78% of people feel grateful for a self-described ‘small’ inheritance and 75% for an ‘average’ inheritance, but this drops to 69% when a ‘large’ inheritance is at stake.* Also, while the overall percentages are quite low, people who inherit a ‘large’ amount are around twice as likely to feel ambivalent or underwhelmed than those who receive a small amount.

The benefits of breaking your silence

Admittedly, talking about what happens after you die is uncomfortable, but it’s also important. And really, while it isn’t an easy conversation to start, talking about your legacy, will, or estate plan should be a conversation about love. A conversation about who and what is important to you.

As part of this conversation, you may consider introducing your children to your financial adviser. It can be valuable to involve your children in your estate plans as this can lead to greater certainty and comfort on a subject which is usually clouded by doubt, worry and angst. When parents discuss their intentions with their children, suddenly the percentage of people who think they will inherit jumps from 53% to 80%.* That’s a lot more people that can plan their future with greater confidence.

There’s also another, perhaps unexpected, side effect of discussing your legacy with your children. It makes them more likely to seek advice and make or update a will themselves. While only 36% of Australians have discussed their will with their parents, this jumps to 55% for people who have a will of their own. A 20% difference.*

_______________________________________________

* Lembit, G., (2019) ‘What do you care about’, Perpetual Client Insights and Analytics, released 26 September 2019