You’ve spent your lifetime building your super balance – you owe it to yourself to choose the best way to access the money when you retire. It’s a good idea to start thinking about it a few years before retirement so you can make the most of your hard-earned savings.

What are your options?

When you retire, you can choose to receive your super by making lump sum withdrawals, by commencing a retirement phase income stream or a combination of both.

If you choose to withdraw your entire super balance as a lump sum, you’re in for a big pay day because your balance is transferred to your bank account. If you decide on an income stream, a designated amount of money is transferred from your super to your bank account at regular intervals, such as fortnightly or monthly. The rest stays in your super and continues to earn investment returns, which are taxed at the concessional rate. You can also combine these options, drawing an income stream as well as making lump sum withdrawals from the remaining funds in your super.

Let’s take a look at some of the pros and cons of each approach.

Option 1 - Taking a lump sum payment

Generally, lump sum withdrawals are received tax free if you’re aged 60 or above and you could use the funds to accelerate repayment of debts with high interest rates, saving you money over the long term. You could also invest the money somewhere else, like a term deposit, or put it towards purchasing a downsized home to live in. Of course you could treat yourself to that overseas holiday or home improvement that has been on your to-do list for a decade (or two).

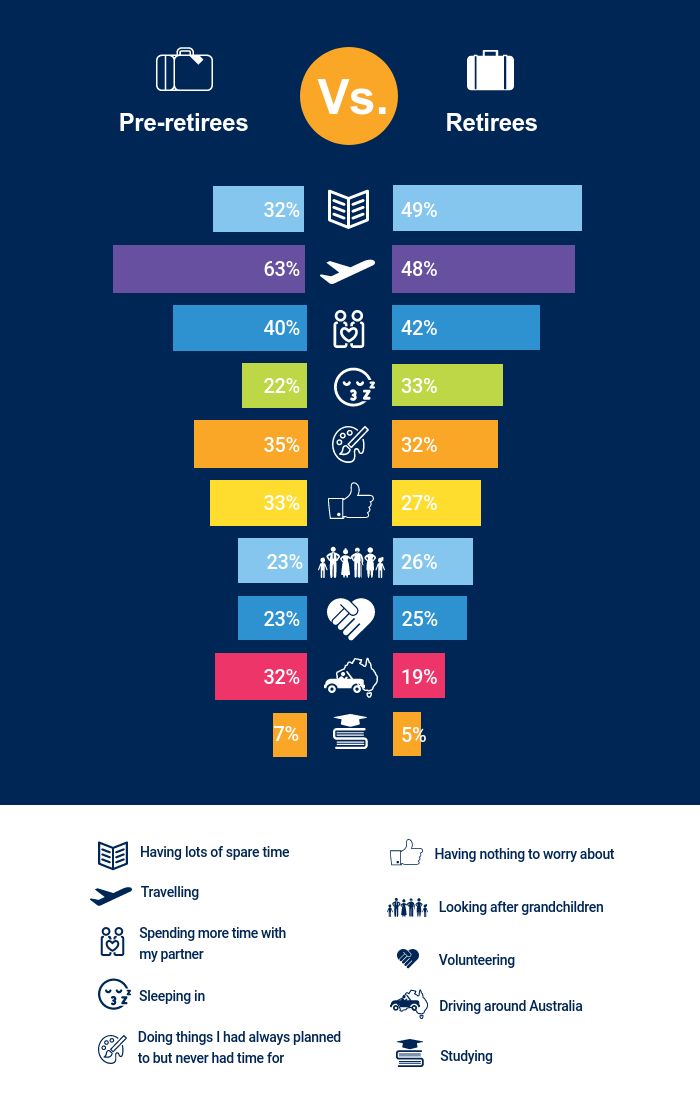

On the downside, spending big when you retire reduces the funds available to support your future income stream. Additionally, using the lump sum to invest outside super may attract higher levels of tax. The other risk in taking a substantial lump sum when you retire is that your circumstances may change later in life. When we compared the experiences of 2,700 Australian retirees with the plans pre-retirees were making, we found there were some interesting discrepancies between plans and reality in areas like travel.

Option 2 – Securing a retirement income stream

This involves transferring all or part of your super to a retirement phase income stream, such as an account-based pension, from which you receive income payments at regular intervals. Think of it as your monthly pay cheque in retirement with the added flexibility of choosing the amount of income you receive. There are compelling tax benefits to this approach because your investment earnings on assets supporting these income streams stay within the super system. This means they are tax free, and for most people aged 60 or above, the income payments you receive are also free of tax. Your money may last longer if you keep it in the super system rather than taking it out as a lump sum payment, which will assist you to maintain your standard of living over the longer term.

There is a maximum amount, however, that you can turn into an income stream. The Federal Government has introduced a ‘transfer balance cap’ of $1.6 million, limiting the amount you can transfer from your super to a retirement phase.

Option 3 – A little bit of both

You also have the option of withdrawing a portion of your money as a lump sum, by transferring your remaining super balance to a retirement phase income stream. This approach would allow you to clear debts or take that European holiday when you retire but keep the rest of your super in a tax effective environment for the long term, withdrawing a regular income.

Which option is the best for you?

It really depends on your personal circumstances – the age at which you retire, how much you have in super, your level of debt and plans for the future. It may make sense to withdraw a lump sum from your super so that you have immediate access to these funds – for planned activities like holidays and unforeseen circumstances like medical expenses – and keep the rest in a retirement income stream with a regular payment you can rely on.

Everyone’s circumstances are different and an experienced financial adviser will take these into account when they offer advice on super as part of your broader investment portfolio. That’s why we strongly recommend you start thinking about your super in the years leading up to retirement and seek financial advice early.

You’ve spent your lifetime building your super nest egg – don’t let it fall from the tree.