Timing is everything. It’s true in comedy, and it’s also the case when it comes to retirement.

After decades of work, moving to the next stage of your life is a time of great anticipation. Your super is at its highest, you’ve planned for a lifetime of retirement income... and then…. 2020 happens.

In the grip of the covid-19 economic crisis, interest rates have been cut and companies are slashing dividends. All of a sudden, retirees relying on dividends for income may be considering withdrawing capital to fund their retirement.

That’s why, now more than ever, it’s important to understand sequence-of-returns risk – or simply sequencing risk – and its effect on your long-term portfolio value. Taking this risk into consideration will give your investments the best opportunity to recover when the market does.

Understanding sequencing risk

When your assets are at their peak, so is their exposure to market fluctuations. If you’re nearing or in retirement and this coincides with the end of a long market rally, this can be bad news.

Significant negative returns in the years around your retirement can have a big impact on your future finances. That’s because you have to sell more shares to get the same income. When the market does recover in the future, you have fewer shares to benefit from the rebound.

Challenges for retirement income

2020 has been a difficult year for generating income from your retirement assets. The effect of record low interest rates has been well documented. Many companies have also cut dividends, including traditional dividend stocks such as the big banks.

This may have a large impact on portfolio income, and for some investors it may be tempting to move from equities to other income generating assets – or drawing down from super altogether to supplement income.

Less retirement income

Knee-jerk selling during times of volatility or a market downturn can have a long-term negative impact on your investment objectives, as your portfolio may no longer match your risk profile.

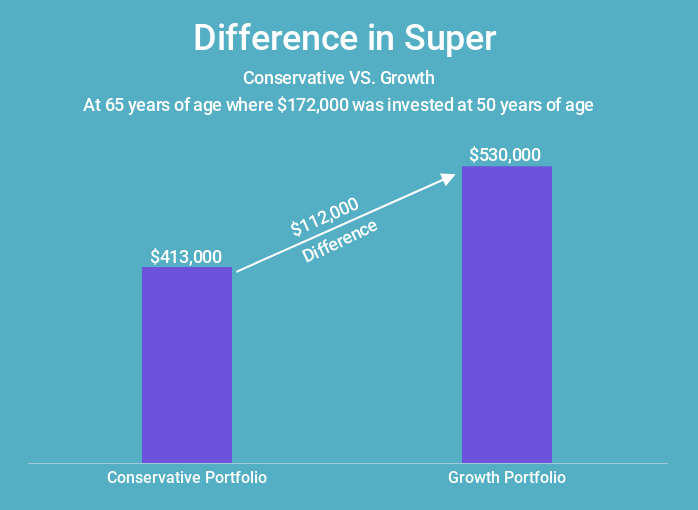

To illustrate this, consider a 50-year-old man with a super balance of $172,000 (the average balance according to research by the Association of Superannuation Funds of Australia).1 With approximately 15 years until retirement, the expected difference of investing in a conservative versus growth portfolio would account to approximately $112,000.* In this scenario, a conservative portfolio would have returned an expected 6.1% over 15 years for a balance of $418,000* and a growth portfolio would have returned an expected 7.8% for a balance over $530,000.*

*Calculated on average estimated Perpetual Private conservative profile returns and Perpetual Private balanced portfolio returns.

Depending on your stage of life, the example above shows how moving from a growth portfolio to a conservative portfolio (as might happen if you move from shares to fixed income assets) at the wrong time can affect your retirement savings.

Due to sequencing risk, if you’re around retirement age you have the most to lose from this strategy.

Perpetual Private National Investment Specialist Andrew Garrett recommends that for long-term investors, the best approach is to keep the faith and understand that markets – and dividends – will rebound.

When considering stocks for a retirement portfolio, Mr Garrett recommends that investors take a ‘total return approach’.

“Stocks that deliver long-term returns – from capital growth and income returns – should deliver a better outcome than simply owning income stocks,” Mr Garrett said.

“Companies with lower dividends, who instead use their revenue to invest back in the business, have more potential to grow income streams and, ultimately, their share price.”

For investors who rely on dividends to pay their bills, it will feel like a long wait for dividend payments to recover. What can you do in the meantime to balance the need for income and minimising sequencing risk?

Weathering market volatility

This year’s market volatility and dividend cuts show how important it is to have a flexible plan for your retirement. While your adviser can tailor a strategy for your individual circumstances, here are some ideas to consider.

- Ensure your portfolio is well-diversified

Research shows that appropriate diversification across asset classes, local versus global markets, and even alternative investments not correlated to the market, can help lower the volatility of returns and lessen the impact of a downturn.

If you’re still working, aim to build a buffer of enough cash – or similar investments such as term deposits – to cover at least one year’s worth of living expenses.

If you’ve recently retired, liquid assets you can draw on outside super may help offset any reduced pension income. Otherwise, in a diversified portfolio aligned to your risk profile, drawing on cash holdings first will help keep your other investments exposed to the market.

- Keep your money in super for longer

If you can afford to, keeping your money in super this year is important, as every dollar you pull out now won’t be there to benefit from a future rise in value.

If you’ve converted your super into an account-based pension (ABP), you may take advantage of the government’s halving the mandatory drawdown limits until 30 June 2021 and reduce your pension withdrawals.

If you’re in a platform or an SMSF you have flexibility to decide how to fund your ABP payment. On the other hand, retail or industry super funds will generally make the decision for you – in either case, speak to your financial adviser to find out more.

- Consider an annuity

Buying a term or lifetime annuity provides you with a guaranteed income stream over a chosen period, regardless of the sequence of investment returns. While an annuity will give you peace of mind, the returns tend to be lower than other higher risk investments, which may not be suitable for everyone.

- Review your spending plans

Whether it’s on travel or new hobbies, new retirees generally spend more than they do later in retirement.

Now is a good time to review your spending plans. While covid-19 is making people delay their big trips, other steps you can also take to reduce your withdrawals and stay invested will minimise the impact on your retirement portfolio.

While wealth accumulation when you’re working may appear simple (save, save, save!) – the best way to draw down on your accumulated assets in retirement can be more complex. Covid-19 is a reminder that generating a steady and sustainable income for your lifetime requires careful planning.

1. ASFA Research and Resource Centre, ‘Superannuation account balances by age and gender’, October 2017.