Structured giving can extend the impact and the longevity of your charitable donations, but you can do even more good if you reshape your financial investments so they’re aligned with your values while also earning a return.

Structured giving

There’s a myriad of ways to ‘give’. You can donate to charities on an ad-hoc basis, you can sign up for regular payments to a major Non-Governmental Organisation (NGO), or you can get strategic and take a considered approach to how your structure your donation, enabling it to grow into perpetuity.

Structured giving is the concept of planning both your donations and your investing to better fund the organisations you support.

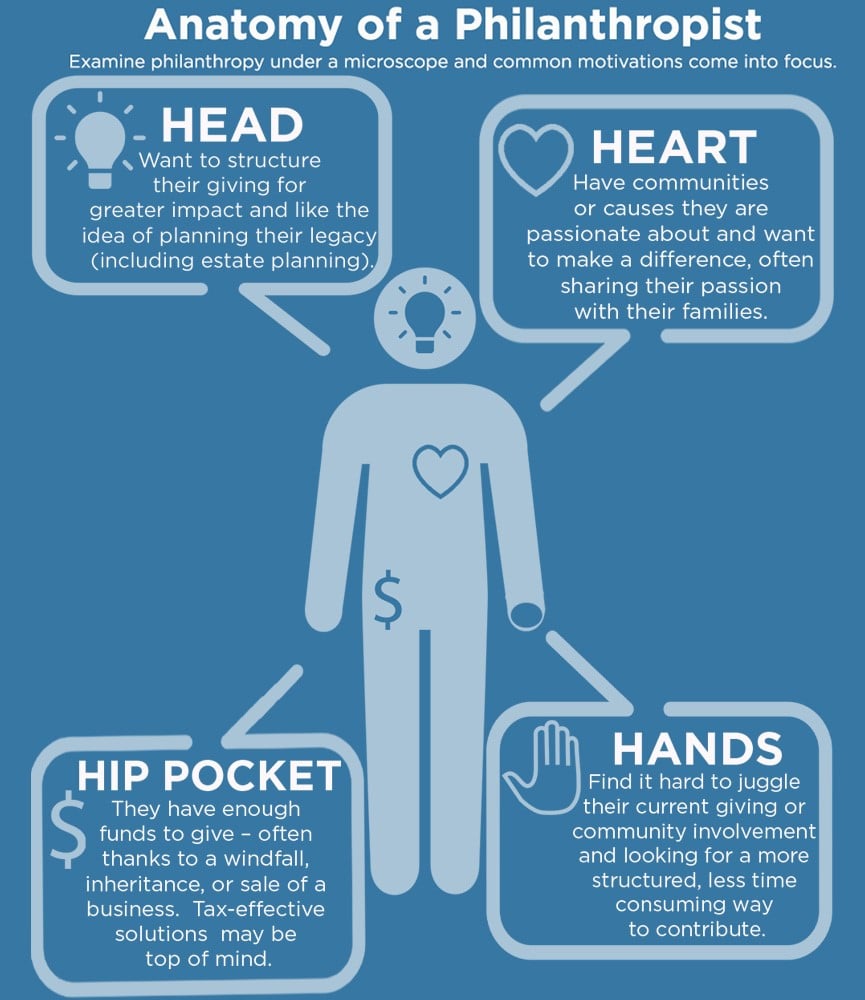

When you first start your giving journey the array of options can be intimidating, and unfortunately for some it can be paralysing. There are so many worthy causes, you need to separate the good operators from the bad, and you need to find the projects that are best aligned with your values.

This is where good advice is invaluable, and it’s where the right structure can save you a lot of time and confusion.

A pooled structure is one option, such as an allocation to an endowment like the Perpetual Foundation. This structure saves you a lot of setup costs, that’s all done for you, and the minimum commitment can be as low as $20,000.

For more control you can set up your own Private Ancillary Fund. This structure takes more effort to set up, so the minimum commitment will be higher.

|

Both the Perpetual Foundation and Private Ancillary Fund options will increase the ‘impact’ of your giving: Efficiency On the whole these structures will be simpler to set up. Payment and distribution platforms can centralise a large part of the process. Legal and financial costs are spread widely so they are reduced. You will receive regular reports and newsletters. Tax effective Your donations are generally tax deductible and deductions can be spread over a period of up to five years. There can also be capital gains benefits to making donations via your estate. Long-term outlook When it comes to charitable giving, there are no quick fixes. For donations to have an impact there needs to long term thinking, but also long-term funding. A giving strategy helps you to make these decisions early on in the process, make a plan and then execute. It’s good for your piece of mind, and it’s a huge benefit for those receiving the funds. Inter-generational giving Deciding to contribute a portion of your wealth to a good cause comes from a deep place. It’s often based around deeply held beliefs that may come from a sense of equality, religious affiliations or simply wanting to help those who are less fortunate. By adding structure to your giving, you can help to engage your family with your decision making. You can help them understand the responsibilities that come from supporting these organisations, and that the structures you’ve set-up have the potential to generate impact even after you’re gone.

|

What do you care about?

Perpetual recently carried out a research report asking 3,000 Australians what they care about.

The results showed that out of those individuals who ‘donate to charitable organisations’ 33 per cent have a preference for responsible investments. This compares to 25 per cent by a control group who receive financial advice.

This suggests there is a link between those who give to charity and those with an interest in responsible investing.

It begs the question of how can you make your investments better align with your values?

Good returns

In the past, most individuals would leave their investment decisions to a financial adviser and simply use the returns that were earned to support the charities or organisations they supported. The problem was, they often didn’t know where their money was being invested.

A well-publicised example of this was the Rockefeller Brothers Fund. The family fund had always been a strong supporter of organisations working to reduce emissions and deal with climate change. So they became understandably uncomfortable when they realised their endowment was invested in companies producing greenhouse gases. They made the decision to move out of those investments in favour of a portfolio more in line with their values.

Such ‘values-based investing’ is becoming increasingly popular in the form of socially responsible investing (SRI) which involves screening out negative companies from a portfolio, or Environmental, Social and Governance (ESG) investing which operates as a filter across three categories.

Modern givers have more options than ever, and with the right tools it’s easy to not only increase your impact, but to also extend its longevity out to future generations.