Don’t jeopardise your future with a financial plan that is living in your past. What worked in your fifties may not be in your best interests once you retire and even less relevant later in your life. The structure of your investment portfolio should be reviewed regularly to ensure it reflects your stage in life. That’s one of the reasons why Perpetual Private conducts annual reviews with clients – to make sure financial plans remain relevant for the long term.

Australians neglect financial advice when they need it most

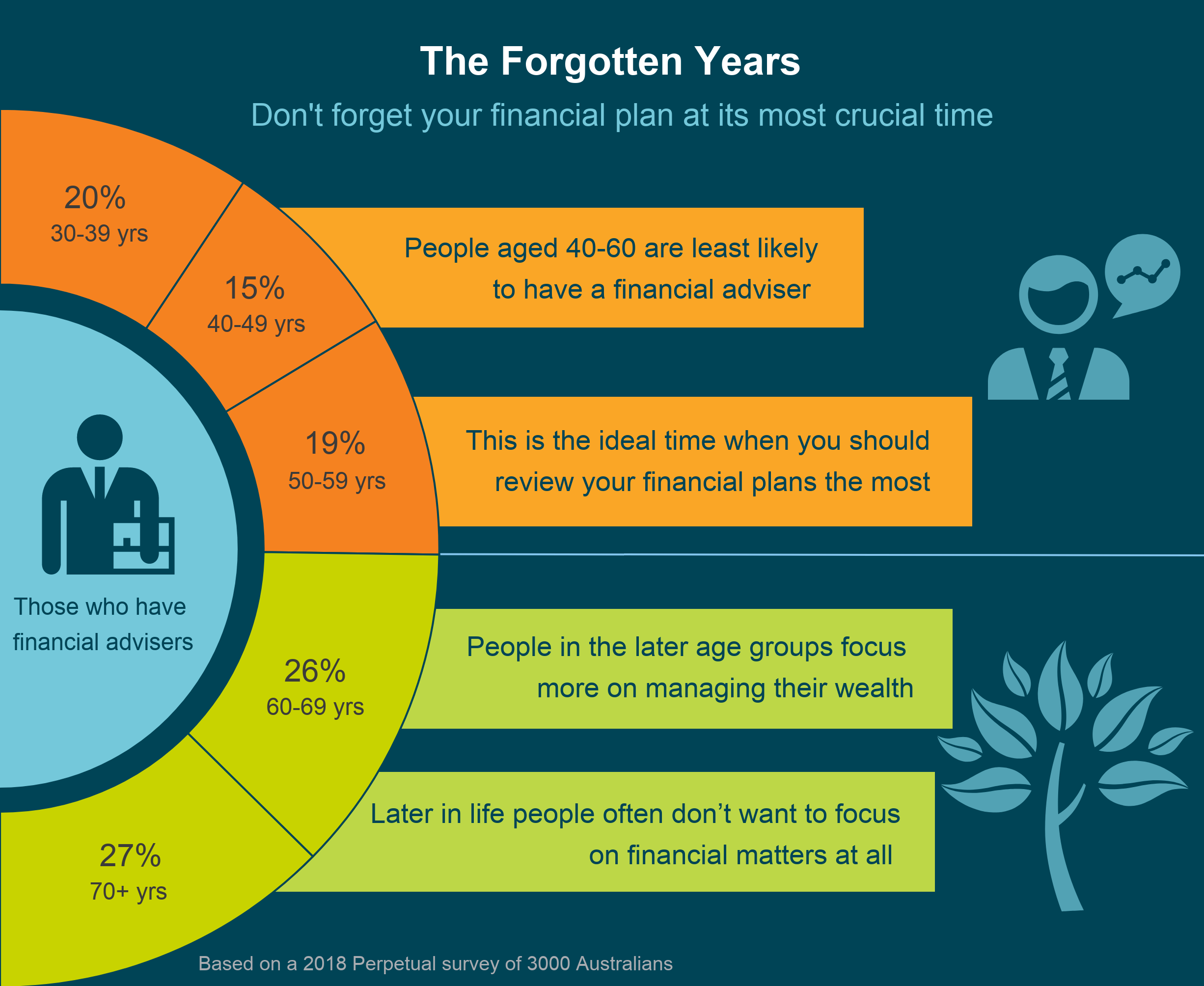

If you haven’t received financial advice or reviewed your financial plan in years, you’re not alone. A recent Perpetual survey of 3000 Australians showed people in their forties and fifties were less likely to receive financial advice.

The paradox is these forgotten years are when a financial plan is most crucial. It’s when your wealth needs to be grown during high income years and then protected for your retirement. During this period your priorities and circumstances will change – so even if you have a plan in place it should be reviewed regularly.

One of the reasons people neglect their financial planning is a lack of time. Our survey revealed that 38% of people in their forties and 32% of people in their fifties say they don’t have enough time to focus on the things that matter. Too often, financial planning is put off for that rainy day that never comes.

You own your own home – now what?

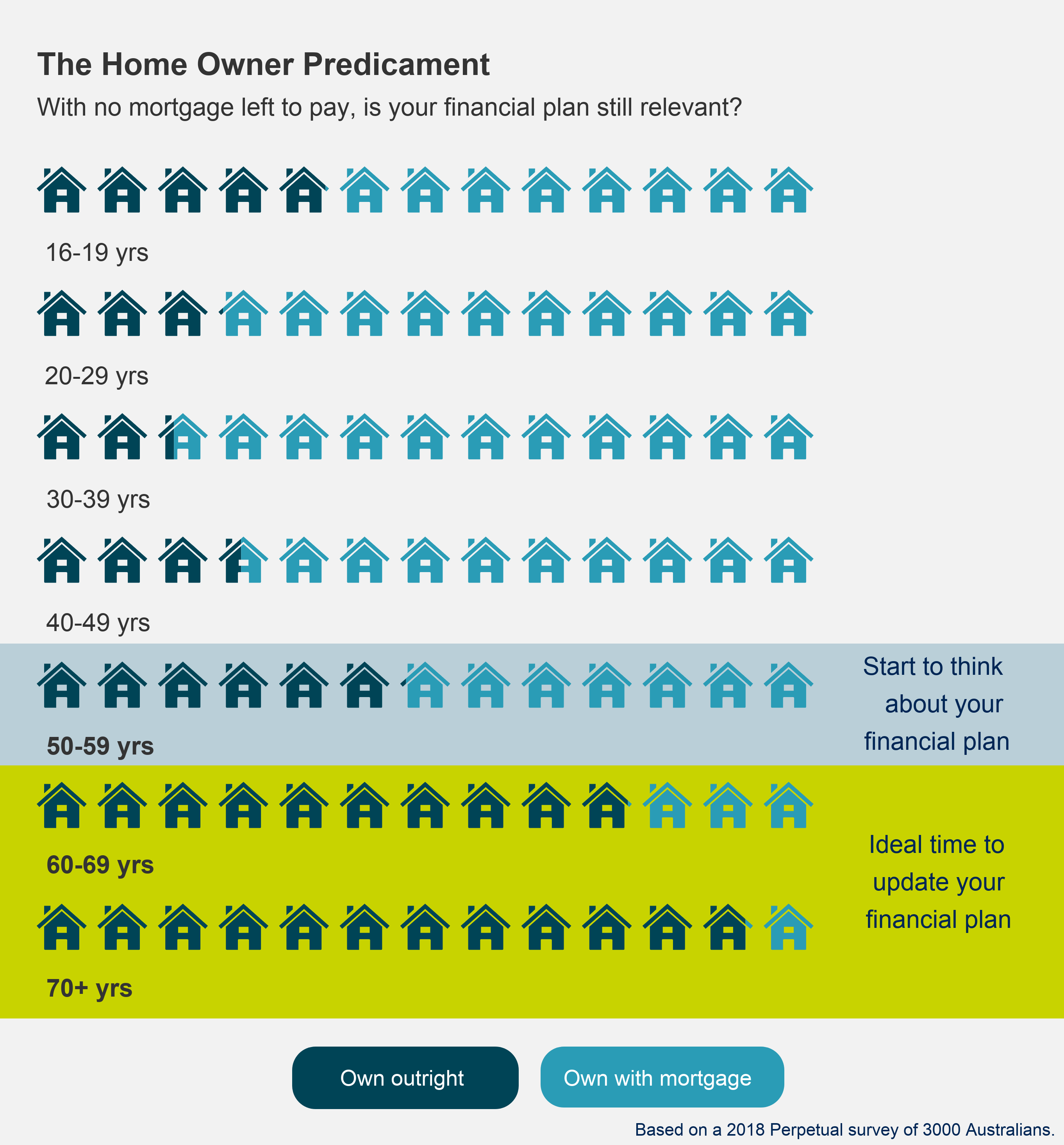

Our research shows a significant increase in the percentage of people who own their homes outright – just 17% of people in their forties jumps to 58% of people in their sixties.

Would the financial plan for a forty year old with a large mortgage still be applicable for a sixty year old home owner?

With the money saved on mortgage repayments the financial plan should be amended to consider other options – shares, property investment and salary sacrificing into super are alternatives worth considering.

Should you take your super as a lump sum?

Your financial plan needs to change significantly once you retire and no longer have an employment income to rely on. Let’s take your superannuation as an example. Your financial plan prior to retirement may have seen you salary sacrificing and using other contribution strategies to maximise your super balance because of the tax efficiencies.

Once you retire, what will you do with your super? If you are eligible, will you take a lump sum payment and use it to pay your debts or purchase a downsized home to live in? Or will you transfer all or part of your super to a retirement phase income stream, such as an account-based pension, from which you receive income payments at regular intervals?

A good financial adviser will help you to make the right decisions, but your financial plan will need to change to reflect your new strategy.

A world in constant flux

Change is the only constant in life – an adage proved true by the shifting global political and economic landscape in recent years. Within an Australian context, we are currently experiencing a residential property slump, further potential interest rate cuts and ramifications from the escalating trade war between the US and China. All of these trends have implications for wealthy Australians and underscore the importance of continuing to review financial plans.