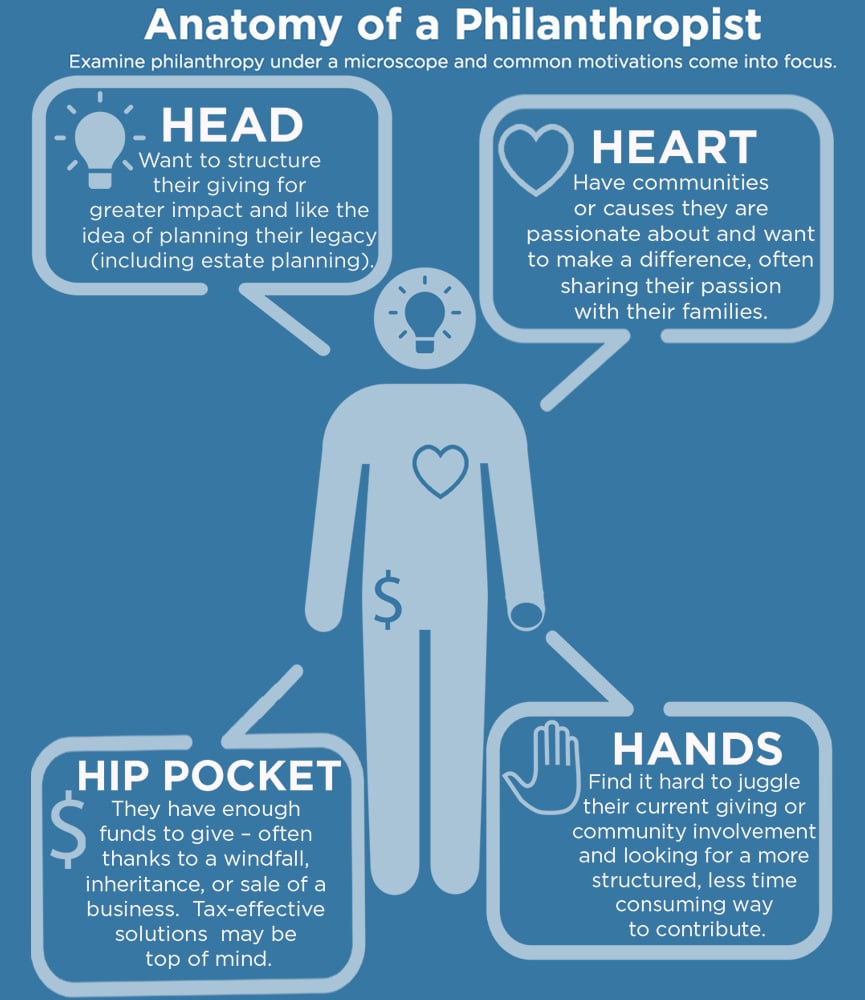

Some people support a cause from the heart, others use their head to structure their giving. For many it’s about hands-on involvement in the community, while others are motivated by a windfall gain. When the reasons people give are analysed, common patterns emerge. Think of it as the ‘anatomy of a philanthropist’.

Did you just call me a philanthropist?

Australians from all walks of life share this anatomy, but few think of themselves as philanthropists. Perhaps it’s because ‘philanthropy’ sounds like something billionaires do. Yet it doesn’t have to be. A simple, structured giving program can be established with a donation of $20,000.

Caitriona Fay, National Manager of Philanthropy and Non-Profit Services at Perpetual comments, “I would encourage anyone with $20,000 or more already committed to charitable giving to consider structured philanthropy. In the lead up to the end of financial year, people should be discussing philanthropy with their accountants and trusted financial advisers because of the tax benefits. I am constantly surprised that philanthropy isn’t considered more frequently as part of the overall tax strategy or estate planning.”

Emotion to action

People follow many paths to philanthropy. For some it may be a windfall event like an inheritance or the sale of a business. Others may have reached a stage in life where they want to structure their giving rather than continue to making ad hoc charitable donations.

Although the paths are many, every philanthropist should determine the most relevant, efficient and tax-effective way to give. This begins with an exploration of their philanthropic anatomy – what is their motivation and what do they want to achieve?

“Philanthropists should begin by deciding what they care about, how they want to contribute, when they want to start and how much involvement their family should have. Their financial adviser should guide them through these considerations in a methodical way so they don’t feel overwhelmed with choice. It should be a rewarding process, not a complicated one,” says Caitriona.

The structuring process can be managed by a trusted adviser, meaning for many the big question is what difference do I want to make?

“For some, structured philanthropy allows them to set goals, engage their loved ones in living the family’s values and ultimately see their wealth make a genuine impact,” says Caitriona.

The case for structured giving

Some people choose to structure their giving rather than making ad hoc donations or to help them provide a sustainable revenue stream to their favoured charities. Structured giving allows the philanthropists to plan when, where and how funds are invested for maximum social return.

Two of the most common structures for giving are:

- Private Ancillary Funds: Philanthropists create their own charitable foundation to benefit their causes in a sustainable way, choosing how the donations are used.

- Public Ancillary Funds: Philanthropists set up an endowment within an already established Fund, thereby avoiding individual compliance, investment and trustee responsibilities.

Once the right structure is chosen, philanthropists can choose from a range of ways to give, such as supporting projects or scholarships, through their estate or in their lifetime, individually or with their family.