Effecting positive change in corporate behaviour is part of their process.

Long gone are the days when socially responsible investing was largely associated with religious organisations objecting to “sin” stocks such as tobacco, alcohol or gambling.

Today, the more evolved environmental, social, and governance (ESG) investing has risen to such prominence that it can compel major corporations to dismantle long-standing, often objectionable, policies.

To understand the full scope of impact and quality of an ESG firm, one cannot simply use traditional measurements; this requires investors and investment managers alike to evolve and learn the complexities and nuances of ESG integration and active management.

Our investment process

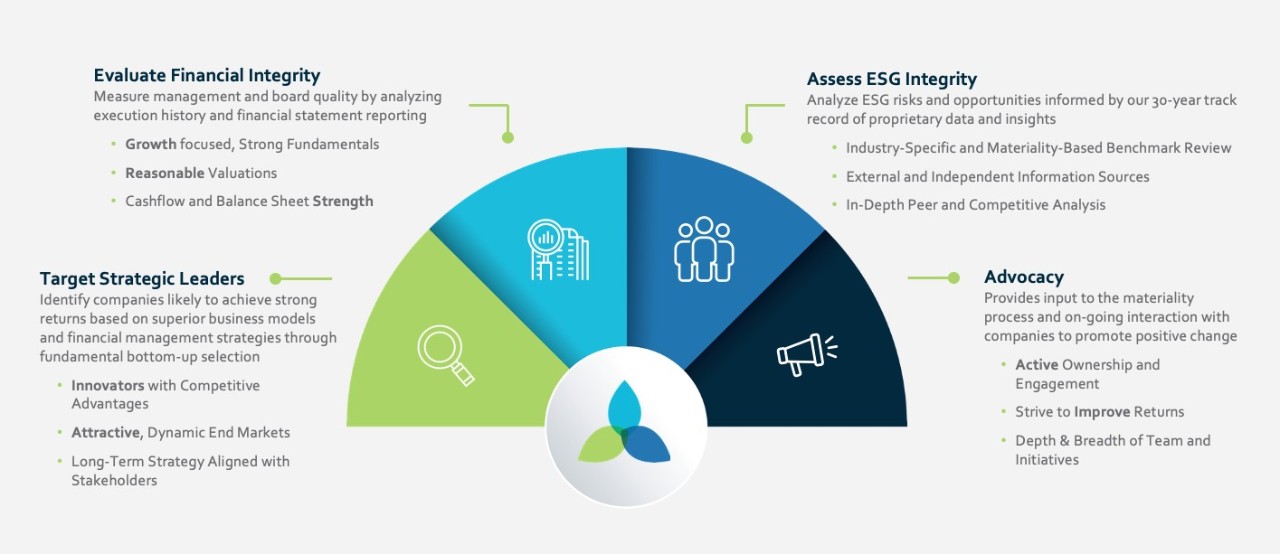

At Trillium Asset Management, we believe we use an authentic, well-vetted approach to ESG integration that is a vehicle for impact and long-term financial performance.

As ESG investors and active owners since our founding in 1982, we were one of the first to incorporate ESG into the investment process –and it was never about seizing a marketing opportunity.

Our approach was instrumental in developing the ESG investment field and the first generation of investors committed to improved environmental, social, and governance outcomes.

We incorporate the evaluation of various ESG issues into our investment process, including climate change, diversity and inclusion, and gender equality. We do this as we seek to provide competitive, risk-adjusted returns for our clients.

We engage with companies and governments, activating stakeholders’ assets to create concrete, positive social and environmental change on a global scale.

More specifically, we incorporate these factors into fundamental financial analysis to identify companies best positioned to deliver long-term performance.

We analyse industries and companies from the bottom up and according to their performance on specific sustainability criteria. Our shareholder advocacy team also engages with the companies we hold to push for change.

Figure 1: Trillium's Sustainable Investment Approach

Source: Trillium Asset Management

Source: Trillium Asset ManagementFundamental research can include company meetings, industry analysis, quantitative screens, idea generation, and a qualitative review.

Our ESG analysis covers industry-specific materiality evaluation, in-depth company research and peer comparison, risks and opportunities, and process monitoring.

There is an important differentiator between a firm or product that fully integrates ESG metrics and an inauthentic product. Full integration seeks to invest in the best companies that display strong ESG metrics through their business practices.

It’s easy to simply screen out the “bad” companies through exclusionary screening methods. Following an ESG risk-based screening process, Trillium’s analysts evaluate companies to determine which ones meet positive thresholds of performance on ESG issues. This review and our fundamental analysis of companies are the primary focuses of our ESG-integrated research.

When evaluating corporate behaviour based on a specific sustainability measure, such as climate change, we might determine whether a company limits the emission of harmful pollutants and chemicals, actively lowers greenhouse gas emissions, or uses renewable energy sources as part of a positive screen. As part of a negative screen, we might exclude companies that contribute to coal mining.

We might restrict companies controversial in areas such as animal welfare, workplace discrimination and human rights, or product safety and marketing. We might also seek to include companies that pay employees a fair wage, support LGBTQ rights, or strive to appoint a diverse board.

Our advocacy

Trillium’s shareholder advocacy team relies on direct engagement, sign-on letters, coalition building, shareholder resolutions and proxy voting to help change corporate behaviour on diversity and inclusion, human rights in the supply chain, climate change, chemical and pesticide reduction, and other pressing ESG issues.

Essentially, we see advocacy acting as a catalyst for positive change, and a crucial step of active ownership.

For example, in the last year our shareholder advocacy helped:

- Put a restaurant company on the path to set science-based, climate-change targets

- A retail company strengthen its diversity and inclusion policies and practices – resulting in the immediate promotion of three women to the previously all-male executive team

- An European grocery retailer join the Chemical Footprint Project, which is focused on reducing the use of toxic chemicals.

In addition to these advocacy efforts with portfolio companies, our advocacy team plays an integral role in the investment process in ESG performance benchmarking, ESG qualitative considerations, and ongoing monitoring of ESG performance.

Long-term view

It’s easy to gloss over corporate behaviour with a surface evaluation, without really understanding the impact of its policies. And it’s easy to dismiss a company’s potential for change when the change doesn’t materialise right away.

We recognise change often happens incrementally over time. Trillium relies on a combination of tactics and strategies, from coalition building to proxy voting to public campaigns to achieve that change.

One thing we have learned at Trillium in the nearly 40 years we’ve spent in this space is that we can just as aggressively seek attractive returns as we can demand ethical outcomes – and win on both fronts.

And even more importantly, we believe these variables, impact and performance, are not independent of one another - to achieve one as an asset manager, you must also focus on the other long term.

Find out more about Trillium.