Trillion-dollar AI chip-maker Nvidia whipped the tech sector into a frenzy this week with its ‘AI Woodstock’ event. But Perpetual’s JAMES HOLT wonders why potential users of AI technology aren’t getting the same market support

- AI-driven boom is reminiscent of the Nifty Fifty

- Conditions may favour value investors

- Find out about Barrow Hanley’s global equities investment solutions

JENSEN HUANG, the CEO of trillion-dollar AI chip-maker Nvidia, had the tech sector in the palm of his hand this week after introducing a new generation of technology at his “AI Woodstock” conference.

Huang’s keynote speech at Nvidia GTC (the acronym stands for Graphical processing unit Technology Conference) was billed as a “transformative moment in AI”.

Not since the Steve Jobs Apple MacWorld events in the 2000s had we seen such hype around a keynote speech.

Huang did not disappoint, announcing next-generation “Blackwell” AI chips which will sell for $US30,000 to $US40,000 per unit.

Nvidia leads the so-called Magnificent Seven US tech stocks with a share-price rise of around 85 per cent lift this year.

Other AI technology suppliers such as Microsoft have benefited as well.

Yet there is a worrying conundrum at the heart of the AI-driven US market surge, notes Perpetual equities investment specialist James Holt.

While the AI tech suppliers continue to grow, most of their S&P 500 counterparts – businesses that stand to enjoy great leaps in efficiency and productivity by leveraging AI technology – have not enjoyed the same market support, he notes.

“There’s a bit of an internal conundrum when you ask what's the purpose of AI?” says Holt.

“AI will make life simpler. It'll slash costs, it'll make doing business easier. It'll save corporates billions.

“But the question is – why has the market priced the providers of AI so high, while the beneficiaries of AI have gone nowhere?

“The top 10 in the S&P500 are around a third of the market. But the other 490 stocks have had virtually no lift at all, even though they are going to be the number-one beneficiaries of AI uplift over time.”

Could the Nifty Fifty happen again?

Concentration in the US stock market is reminiscent of the 1970s Nifty Fifty bull market, argues Holt.

“In 1972 there was a strong view that all you needed to do was own a select group of 50 high-quality companies like McDonalds, Disney, Xerox, Eastman Kodak and Sears Roebuck, regardless of price.

“These companies so-called Nifty Fifty stocks were considered the highest quality – all were dominant in their industry.

“They became known as ‘one-decision’ stocks – you just had to make the decision to buy them and then you could rest easy.

“Many of those companies were great – some survive and thrive today.

“But others subsequently went broke, and all of them suffered big share price declines in 1973 and 1974 as the quality bubble imploded.”

Holt also points to the dot com boom-and-bust in the 2000s, which had a similar narrative

This patterning is one of the reasons Holt believes the current AI-driven market will also inevitably peak.

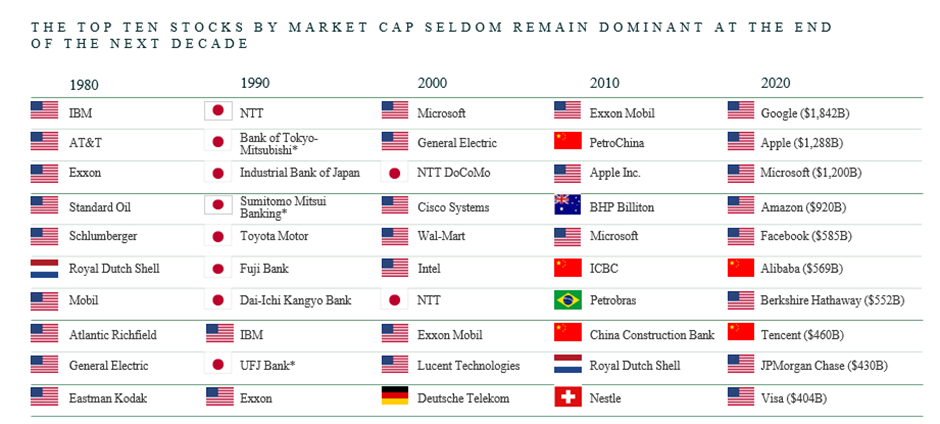

“Market history shows that when the top ten stocks become the top ten stocks, most of them then subsequently underperform,” says Holt, as the chart attached shows.

“These stocks have had so much capital poured into them – and they’ve been revalued to such high levels – that they are highly likely to eventually underperform.

“The other 490 stocks on the S&P500 have a better chance,” argues Holt. “Some should end up finding their way into the top ten, as has historically happened again and again with a new market movement.”

Why value investing, why now?

Value investors like US-based asset manager Barrow Hanley – which is distributed in Australia through Perpetual Group – aim to identify the beneficiaries of market movements, and build a portfolio of undervalued stocks with quality growth characteristics.

“We are continuously screening the universe for what looks undervalued,” says Holt.

“Within those pockets of undervaluation, we search for the best quality stocks to build an undervalued portfolio with the potential for better margins, better return on equity and better earnings growth.”

Many value managers are cyclical or defensive in nature and tend to boom and bust with market cycles, says Holt.

But Barrow Hanley aims for a diversified portfolio that can perform in different stages of a market cycle.

And yes – that includes owning tech companies at the right price.

“As an example, we own Vertiv Holdings, which has done very well over the last couple of years because it was an undervalued way to play tech,” says Holt says.

“It’s involved in data centres and the provision of services to data centres without taking on too much risk in the portfolio.”

As the market approaches another peak, Holt adds it could be time to consider allocating to a fund manager that looks beyond what’s doing well right now at what could perform over time instead.

“If you’ve got more and more of capital in a handful of names that are doing well but growing more expensive, you may be better off rebalancing client portfolios into other opportunities,” he says.

“And that rebalancing at the moment should be occurring towards value.”

About Barrow Hanley

Barrow Hanley is a global leader in value investing, managing assets for clients for more than 40 years.

Barrow Hanley Global Share Fund aims to provide investors with long-term capital growth through investment in quality global shares.

Rated "Highly Recommended" by Zenith, "Recommended" by Lonsec and with a Morningstar Medallist rating of "Gold", the investment team focuses on finding value in all the right places.

Barrow Hanley is distributed by Perpetual Group in Australia.