Global equity markets started off the year on a strong note, with both the MSCI World and MSCI All Country World Indexes up more than 7% in January. James Carpenter, Director and Client Portfolio Manager at Barrow Hanley, looks at a few drivers of the investor optimism underpinning this market performance and how the Barrow Hanley Global Share Fund performed over the month.

There were several economic factors providing optimism for investors over January that perhaps a recession (hard landing) might be avoided in 2023. Inflation in the US and Europe seem to have peaked and modest declines in inflation are being seen that indicate central bank tightening has had its intended effect, with smaller rate rises expected – if not a complete halt to rate increases, at least in the US, in the next few months. Further, employment and job openings remain strong. In the US, this translated to strong performance within smaller capitalisation stocks, which tend to benefit from a positive outlook on an economic recovery, while their larger cap peers lagged not only in the US, but also trailed their global peers.

The Eurozone also saw a surprise rebound in its composite Purchasing Managers’ Index (PMI )to 50.2 in late January, with improving sentiment on the back of declining gas prices given a milder winter than expected and a decreasing risk of future shortages as gas storage levels have improved meaningfully from a year ago. Combined with a weakening US dollar, continental European equities saw the strongest returns in the month, up more than 9%. However, high inflation persisted in both the UK and continental Europe and the European Central Bank raised rates 50bps, compared to the U.S. Federal Reserve, which has now slowed its interest rate hikes to 25bps.

In Japan, it was the opposite, with inflation increasing to 4% year over year, its highest reading in 31 years – something the government has been aiming for during this prolonged period of stagflation in Japan. However, it was not all positive, as higher inflation caused real wages to decline to their worst reading in more than eight years, pressuring the government to push for higher wages. Elsewhere in Asia, China’s move away from zero Covid continued to push Chinese equities higher, with China up nearly 12% in the month and Chinese equities up more than 50% since their October lows. Similarly, Taiwan and Korea were both up more than 12%, all of which helped the MSCI Emerging Market Index to post strong returns.

Given the expectation of fewer rate increases as central banks potentially ease later in the year, growth stocks saw a strong rally after a dismal 2022, with the MSCI World Growth Index outpacing the MSCI World Value Index by 5%. Growth stocks were favoured broadly across sectors, with the Information Technology, Consumer Discretionary, Health Care, Communication Services, and Consumer Staples sectors leading the growth index higher. In stark contrast, value stocks in both the Health Care and Consumer Staples sectors produced negative returns in the month, with Energy and Utilities stocks also lagging the broader index.

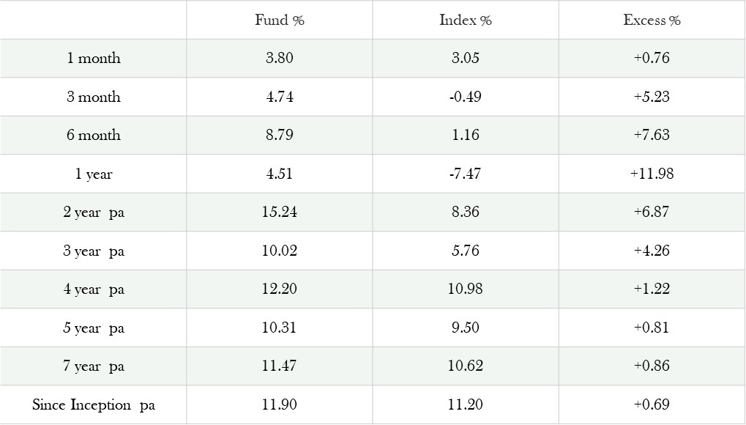

Barrow Hanley Global Share Fund performance

Despite the market’s preference for growth stocks in the month, the Barrow Hanley Global Share Fund outperformed the MSCI World Index in January, adding to the strong performance over the December quarter (see table 1).

Table 1: Barrow Hanley Global Share Fund - Class A

Net Fund performance (AUD) ending 31 January 2023

Note: Inception Date 27/08/2014. In September 2020, Barrow, Hanley, Mewhinney & Strauss, LLC commenced as Investment Manager of the Fund. Returns are annualized for periods of more than one year. Returns represent the performance of the Barrow Hanley Global Share Fund – Class A (APIR: PER0733AU). Index returns are shown before transaction costs, management fees, and other expenses. Performance is expressed in AUD currency. Performance figures shown are post fees/pretax. Past performance is not indicative of future performance. Total returns shown for these strategies have been calculated using exit prices after taking into account all of Perpetual’s ongoing fees and assuming reinvestment of distributions. No allowance has been made for taxation. Source: Perpetual Asset Management Australia & State Street Australia/RBC.

For the month, stock selection was the primary driver, as the fund had positive selection in eight of the 11 sectors, with selection in the Consumer Discretionary, Industrials, and Consumer Staples sectors the largest contributor to relative returns while selection in the Information Technology, Health Care, and Utilities sectors added more modestly to relative returns. The fund’s overweight to the Information Technology sector was an offset to performance despite positive stock selection within the sector. Regionally, holdings in emerging markets and effective selection in the US and the UK added to relative returns while challenging selection within continental Europe was a modest headwind to performance.

Top Contributors

Lithia Motors and Aptiv PLC, both in the auto space, were the top contributors in January after being the top detractors in December. The Automobile and Parts industry was the strongest performing industry in January, up nearly 31% in the month, with both stocks benefitting from this strong performance. With lower interest rates beginning to be expected for later in the year, lessening fear of a recession and lessening supply chain constraints were likely drivers to the stronger performance within this space. Both stocks continue to present a compelling risk/reward profile.

SeaWorld Entertainment performed strongly in January, though the performance was not driven by any specific fundamental. The stock has likely benefitted from increased consumer confidence and a willingness for consumers to continue to spend money on experiences rather than goods. Historically, the stock has done well in challenging market environments, and we believe that even if markets soften later in the year, the stock should continue to perform well.

Top Detractors

After being among the top contributors in December, Merck & Co underperformed in January along with another Health Care holding, Elevance Health. Both stocks were challenged by the market rotation out of the Health Care sector after its stellar 2022 performance. Both companies continue to deliver excellent financial results and we believe each still presents a strong risk/reward opportunity.

Allstate Corporation detracted from performance in the month as markets expected a challenging period for Allstate given December’s winter storm Elliot and continued challenges in its auto book. Allstate has continued to face challenges that we are monitoring but we currently feel our investment thesis, though delayed, remains intact.

Market Outlook

We are encouraged by positive economic data highlighting that we may have seen the worst in inflation readings. Further, strong employment continues to keep the consumer afloat as have prior savings during the COVID period. Further, stabilizing or improving PMIs could be a strong signal that global economies may be able to avoid a hard landing. However, with strong economic data comes continued pressure on inflation, which is likely to cause central banks to be reluctant to lower interest rates in the near future. Accordingly, as we have seen in previous value-led markets, growth rallies within a value cycle can be strong when investors expect a “pivot,” but growth will tend to lose out to value until there is a meaningful and permanent shift in central bank policies and an actual turn in economic growth.

Even under these scenarios, we would expect markets to continue to favour value stocks as cyclical sectors tend to outperform in an economic recovery. As such, we believe that it is too early to say whether global markets will experience a hard or soft landing, but we recognise the material risks associated with central banks wanting to raise rates until there is some pressure in the labour market. Accordingly, we believe our fund, which is modestly tilted towards defensive stocks, remains appropriate in this uncertain market environment.