“It is never too late to be who you might have been.” George Eliot

A well planned retirement can be the best phase of your life. Time to travel. Write that book. Indulge your passions. Give back to the community.

When people come to Perpetual for financial advice we are inspired with their plans for life after work. Everyone’s aspirations are unique but all too often united by a tendency to overestimate how much income they’ll be able to generate from their retirement savings.

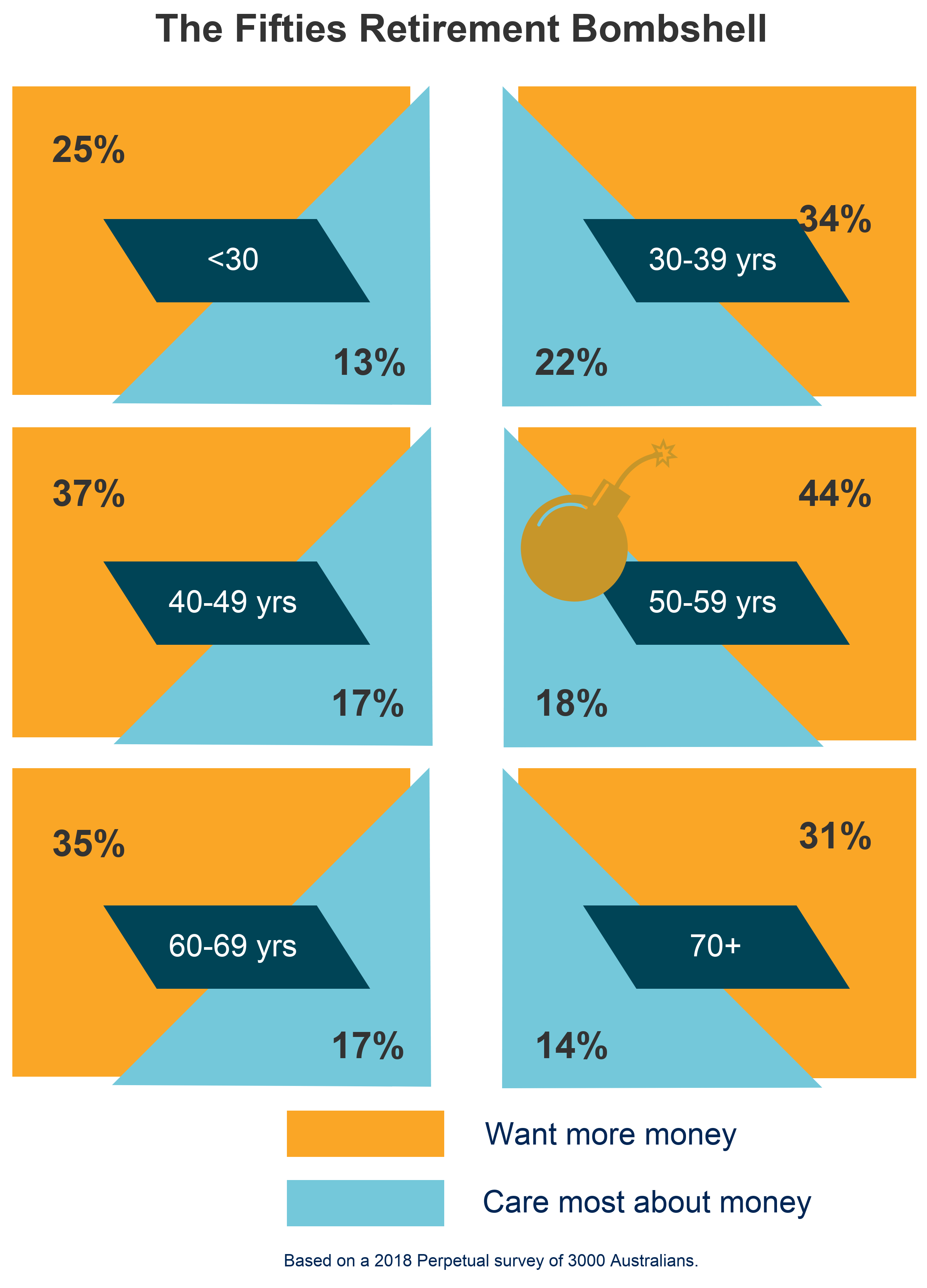

The bombshell often drops when pre-retirees are in their fifties and early sixties. It’s a trend supported by a recent Perpetual survey of 3,000 Australians.

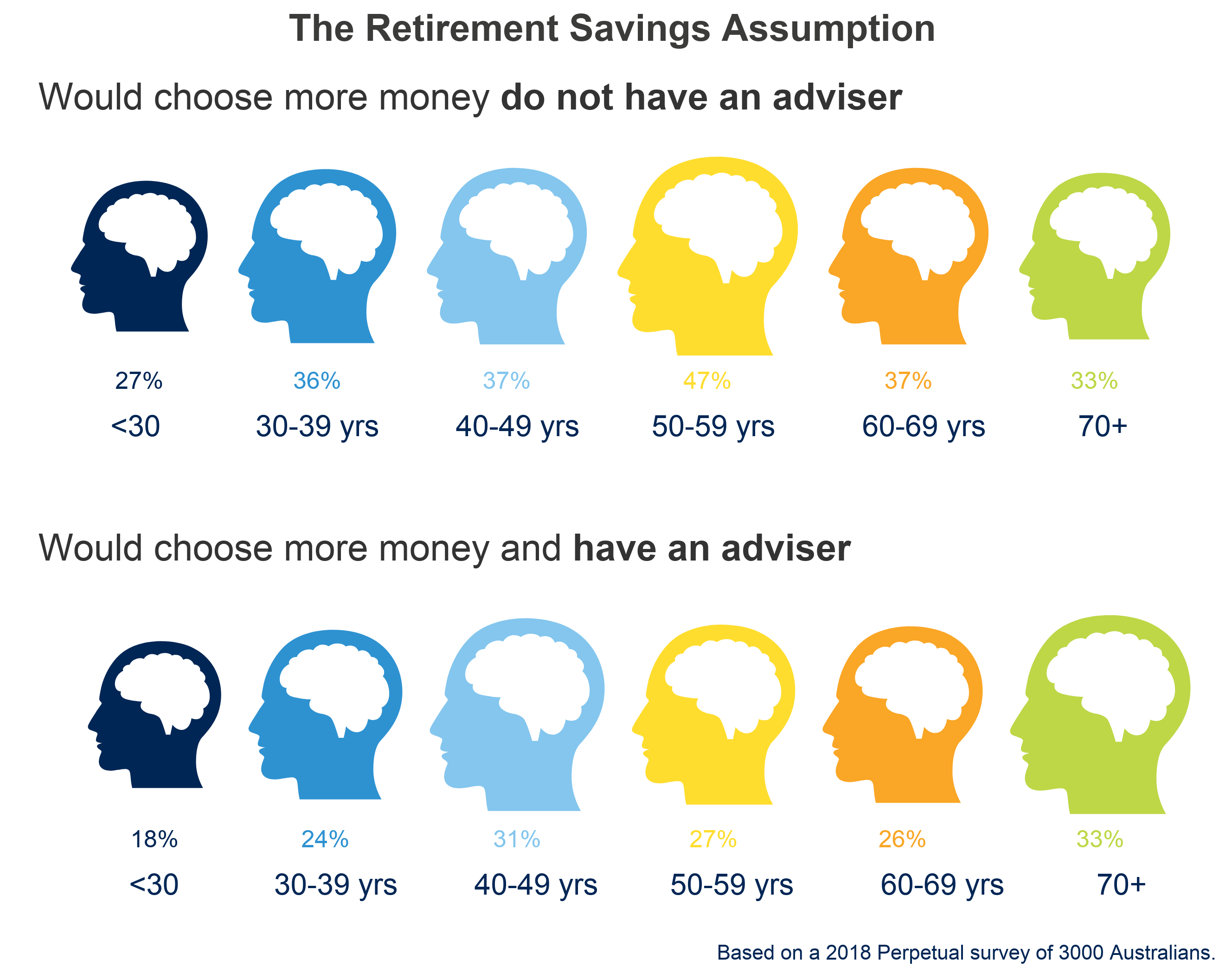

When it comes to wanting more money, there’s a clear spike when unadvised Australians are in their fifties.

Assumptions you can’t afford to make

Here are three common misconceptions people have when they first talk to us about structuring their retirement income:

- I’ve saved enough to generate the income I will need for my retirement.

People retiring now need a nest egg far bigger than retirees just a few decades ago. As a nation our life expectancy is increasing which means our savings need to stretch a lot further. Generating the monthly income you need in retirement without depleting your nest egg requires a detailed financial plan.

- I prefer to invest in Australian shares because I understand the market

The investment portfolios and SMSFs of many Australians are largely comprised of domestic shares, with some having little or no exposure to bonds or international shares. This lack of diversification increases the risk of capital loss should there be a significant downturn, something that was experienced by many close to retirement during the Global Financial Crisis.

- I’ve always been healthy, why should retirement be any different?

The cost of future medical care is another area that pre-retirees underestimate when thinking about their retirement. With private health insurance and Medicare only covering some of the costs, any unplanned ‘out of pocket’ medical expenses can deplete your retirement savings.

What happens when your assumptions are wrong

We looked at pre-retirees and compared those who had a financial adviser with those who didn’t.

The biggest difference between the groups related to money – those without an adviser placed almost twice as much importance on having more money.

This is a compelling finding because it highlights what can happen when assumptions about retirement savings prove to be wrong. Without the objective advice of a financial adviser, people are more likely to be stressed about their financial situation as they approach retirement. It reaches a crisis point in their fifties.

Avoiding the fifties retirement bombshell

We’ve been advising Australians for more than 130 years and in our experience, pre-retirees feel comfortable about their retirement when they know three things:

- Their wealth will be protected for their lifetime

- Their retirement income will be sufficient to meet regular living expenses

- They will have enough discretionary funds for treats like travel or nasty surprises like unexpected medical costs

To answer these crucial questions, you need a bespoke financial plan that has been designed by an adviser who has taken the time to understand you. At Perpetual, this is something we feel truly passionate about. We’ve seen how the right financial advice can transform a person’s retirement for the better.

Never too soon for advice

“Good fortune is what happens when opportunity meets with planning.” Thomas Edison

The sooner your financial plan is in place the better because time in the market is your best friend. Research shows those who receive financial advice are almost $100,000 better off when they retire so it’s clear that having a professional by your side can make a significant difference. 1

1. Financial Services Council, 'Better off with savings advice' research, February 2011.